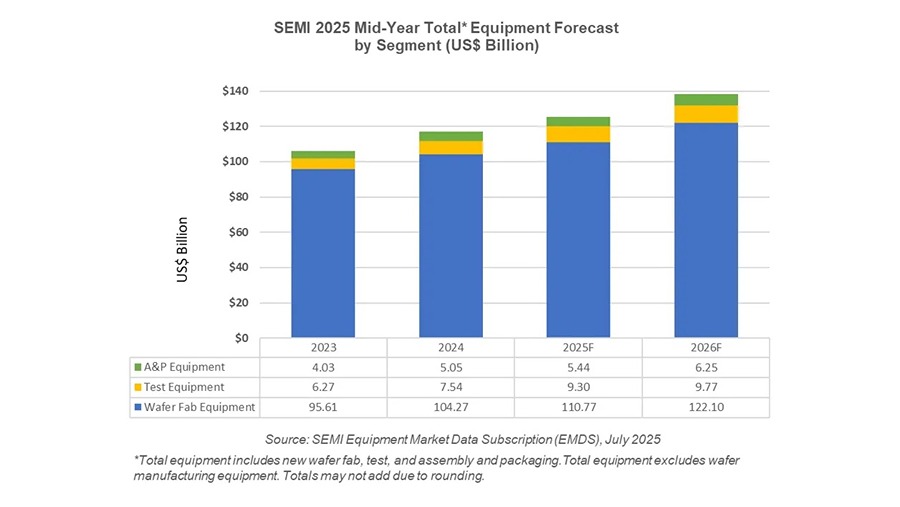

SEMI reports global total semiconductor equipment sales forecast to reach $125.5 billion in 2025.

SEMI announced that global sales of semiconductor manufacturing equipment by original equipment manufacturers (OEMs) are projected to reach $125.5 billion in 2025, a 7.4% year-on-year increase, according to its Mid-Year Total Semiconductor Equipment Forecast – OEM Perspective. Sales are expected to continue growing in 2026, reaching $138.1 billion, supported by advancements in logic, memory and ongoing technology shifts.

“Following strong growth in 2024, global semiconductor manufacturing equipment sales are forecast to expand again this year and set a new record in 2026,” said Ajit Manocha, SEMI president and CEO. “While the semiconductor industry is closely monitoring macroeconomic uncertainty, AI-fueled demand for chip innovations is driving investments in capacity expansions and leading-edge production.”

Semiconductor equipment sales by segment

After reporting $104.3 billion in sales last year, the Wafer Fab Equipment (WFE) segment, which includes wafer processing, fab facilities and mask/reticle equipment, is expected to grow 6.2% to $110.8 billion in 2025. This revision from SEMI’s 2024 Year-End Equipment Forecast of $107.6 billion is primarily due to higher demand in foundry and memory applications. In 2026, WFE segment sales are expected to increase by 10.2% to an estimated $122.1 billion, driven by investments in advanced logic and memory to meet AI-related demands, along with continued updates to manufacturing technologies across key markets.

The back-end equipment segment is expected to maintain its recovery that began in 2024. After recording 20.3% year-on-year growth in that year, sales of semiconductor test equipment are projected to increase by 23.2% in 2025, reaching $9.3 billion. Assembly and packaging equipment sales, which rose 25.4% in 2024, are forecast to grow 7.7% to $5.4 billion in 2025. Growth is expected to continue in 2026, with test equipment and assembly sales rising 5.0% and 15.0%, respectively, driven by complex device architectures and the high performance demands for AI and high-bandwidth memory (HBM) semiconductors. These gains are moderated by ongoing softness in automotive, industrial and consumer end markets.

WFE sales by application

WFE sales for foundry and logic applications are expected to increase byf 6.7% year-over-year to $64.8 billion in 2025, primarily due to sustained demand for advanced nodes. In 2026, the segment is expected to grow by an additional 6.6%, reaching $69.0 billion. The growth is supported by ongoing capacity investments and increased interest in newer process technologies, as the industry moves toward high-volume manufacturing at the 2nm gate-all-around (GAA) node.

Memory-related capital expenditures are projected to increase in 2025 and continue rising in 2026. NAND equipment sales are gradually rebounding after the decline in 2023. Following a 4.1% increase in 2024, the NAND equipment market is expected to grow by 42.5% to $13.7 billion in 2025 and by 9.7% to $15.0 billion in 2026, due to developments in 3D NAND technology and expanded production capacity. DRAM equipment sales, which rose 40.2% in 2024 to $19.5 billion, are forecast to grow by 6.4% in 2025 and 12.1% in 2026, reflecting continued investments in HBM for AI applications.

Semiconductor equipment sales by region

China, Taiwan and Korea are expected to continue as the three largest markets for equipment spending through 2026. China is expected to maintain the highest spending level, although investment is expected to decline from the 2024 total of $49.5 billion. All other regions, except Europe, are anticipated to experience increases in equipment investment beginning in 2025. However, elevated trade-related uncertainties could affect the growth trajectory across regions.

The SEMI forecast is based on collective input from top equipment suppliers, the SEMI Worldwide Semiconductor Equipment Market Statistics (WWSEMS) data collection program, and the industry-recognized SEMI World Fab Forecast database.

Edited by Puja Mitra, WTWH Media, for Control Engineering, from a SEMI news release.