The manufacturing industry output (MIO) tracker from Interact Analysis reveals a stronger than expected overall global manufacturing performance in 2020.

The manufacturing industry output (MIO) tracker from Interact Analysis reveals unexpectedly strong overall global manufacturing performance. This is an upward revision on the previous MIO updates. At our most pessimistic point, we forecast a -4% contraction in industrial output for China. But the country’s rigorous suppression of the virus meant that production was back on track by May 2020, and the region is now posting 1.9% growth.

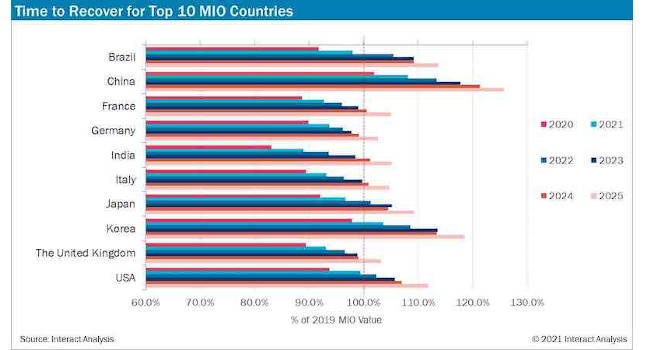

The Chinese recovery has had a significant impact on global growth, but it still represents considerable overall lost growth, putting China among the four global loss-leaders, along with India, Japan, and the USA, who have together racked up in excess of $200 billion in lost MIO potential. Korea’s track-and-trace strategy has been hugely effective, and the country has seen strong growth in the electronics and components sectors resulting in overall negative growth of only -2.4% for 2020.

In Europe, Germany’s economy in particular has suffered, and recovery will be sluggish. Key factors here are the country’s huge reliance on export markets in Eastern Europe and globally, notably in the automotive and metals sectors which have both fared badly in the pandemic.

Where industrial machinery is concerned, one of the biggest casualties globally has been the machine tools sector, which has been hit hard by the major slow-down in the transportation industries. In Germany, machine tools is down 30% and this is reflected in weak performance in other European countries too, such as the UK where the machine tools market is expected to be down over 30%. Europe is not alone: few of the major regions are likely to return to 2019 levels in the next 6 years.

COVID-19 has driven, and will continue to drive, the demand for plastic and rubber medical supplies and personal protective equipment. However, the rubber and plastics machinery sector did experience a decline in demand in 2020 with Korea, India and the U.K. seeing contractions of the order of -15.8, -13.9 and -13.4% respectively. However, all the top 10 regions are expected to recover to 2019 levels by 2023 at the latest. Strong APAC performance will bolster a growth that will see production values rise from $49.6 billion in 2020 to $53.4 billion in 2021.

Adrian Lloyd, CEO at Interact Analysis, said: “The semiconductor and electronics machinery sector is one of the few sectors to have come through the pandemic untouched. Most major regions are forecast to grow past 2019 levels in 2020, with global growth forecast at 9.9%. The few who don’t will be back up and running at a stronger level than 2019 by 2021. Growth will likely be slightly slower in 2022 and 2023 but will remain positive. APAC is the leading producer of semiconductor and electronics machinery. We forecast a 5-year CAGR for Korea of 9.1%. It’s a good sector to be in. But some regions really need to play catch-up.”

– Edited from an Interact Analysis press release by CFE Media.