Pent-up demand due to challenges from the COVID-19 pandemic are expected to result in strong growth for the motor and industrial gear markets in the next few years.

The gearbox, the unsung hero of the drivetrain, is also an essential industrial component because it offers enhanced motion control and enables smaller motors. Our new research on the geared motors and industrial heavy duty gears market highlights important trends for a range of equipment types, including light-duty geared motors and solo gearboxes, parallel and bevel heavy duty geared products and planetary geared machinery.

Pent-up demand from 2020 brought 8.4% growth in 2021

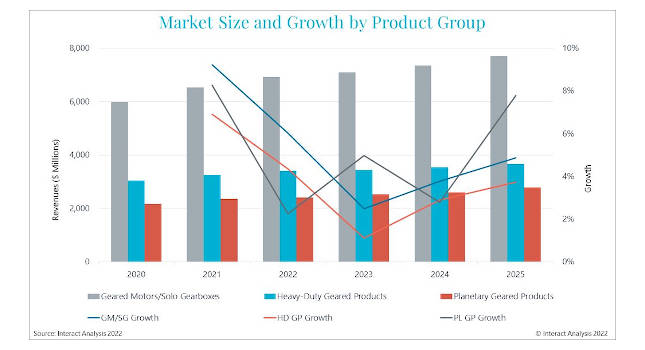

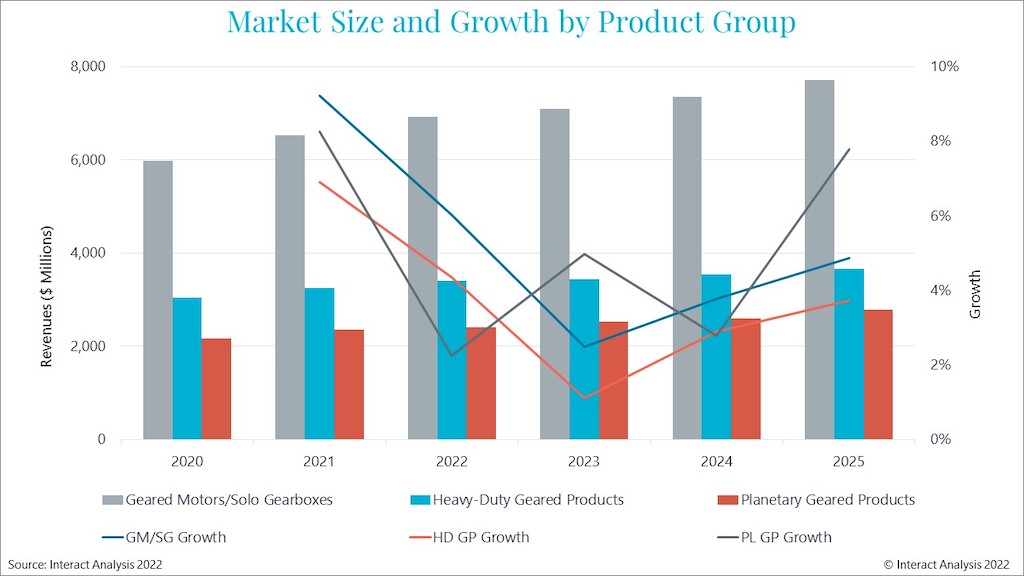

2020 was a difficult year for the geared products sector. Overall, the market declined by 2.4%, Asia-Pacific (excluding Japan) being the only region to see positive growth – 5% year-on year. EMEA, the Americas and Japan saw contractions of 7.2%, 6.9% and 8.2% respectively. Asia-Pacific, with its huge industrial base, including China, the world’s largest single country market, accounted for 47% of global market revenues in 2020. Meanwhile, EMEA claimed a 34% share, and the Americas accounted for 19%. As we progressed into 2021, demand for geared products increased, and revenues rose owing to supply-chain disruption. We estimated 8.4% YoY growth in the global market for geared products in 2021, but things will level off from 2022 onwards. The lowest rate of growth will be in 2023, when we anticipate renewed uncertainties regarding economic growth and investment: the usual up-and-down market cycle. Out to 2025, the market is forecast to grow with a CAGR of 5% in Asia-pacific, and 4.7% in the Americas and EMEA.

Light-duty geared products are market leaders, but planetary gears have wind in their sales

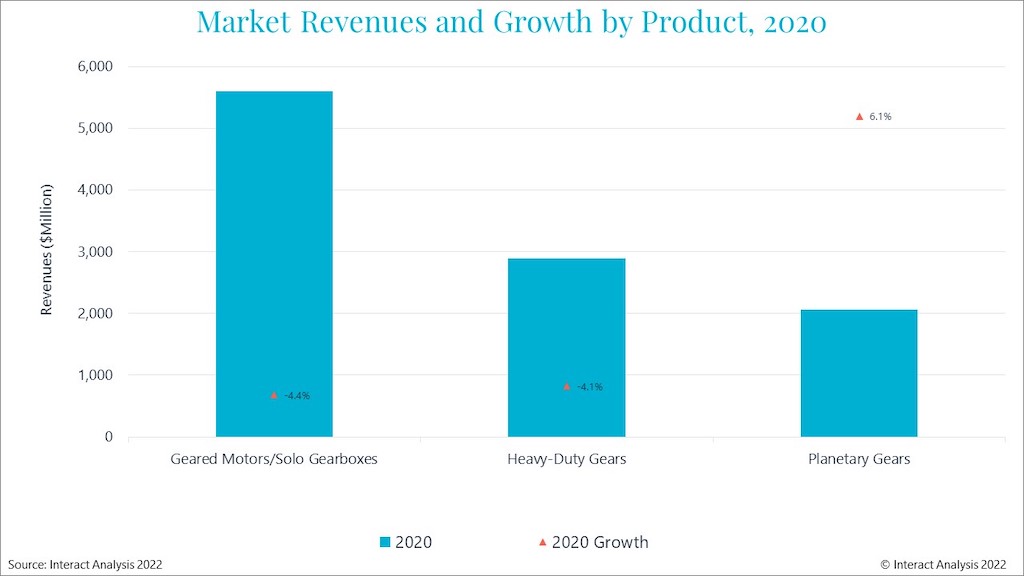

In 2020, geared motors and solo gearboxes were the leading product category, accounting for 53% of total global revenues, but sales were down by 4.4% and sales of heavy duty geared products (with a 27% market share) saw a 4.1% contraction. It goes without saying that these dips were due to slow downstream demand from companies slashing investment in the teeth of the pandemic.

The only product group achieving year-on-year growth in 2020 was planetary geared equipment. This 6.1% growth was mainly due to the surge in demand for planetary gears for use in pitch, yaw, and azimuth applications in the wind turbine industry, notably in China and the USA. We forecast 4.8% annual growth out to 2025 for the geared motors and heavy-duty gears market, when we expect annual revenues to be $14,165 million. Breaking that market up a bit, we expect light-duty products to grow with a CAGR of 5.5% over the forecast period, planetary geared products 5.2%, and heavy-duty geared equipment seeing the lowest CAGR – 3.8%.

Sales to warehouse and parcel sectors expected to boom, with a CAGR of 10.4%

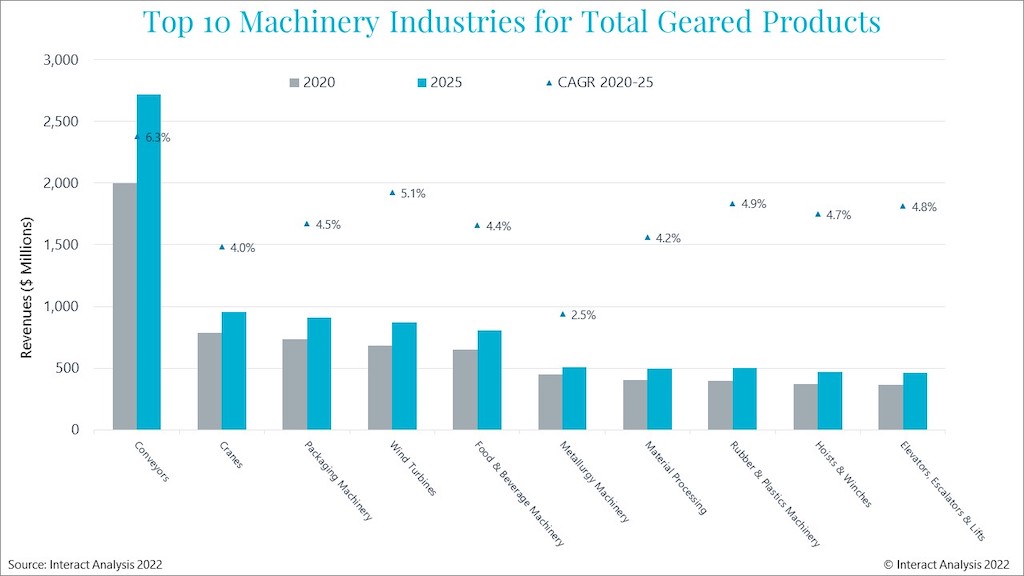

Machinery manufacturers are the main consumers of geared products. In 2020 they accounted for 74% of revenues. We predict revenues from sales to the machinery sector to grow with a CAGR of 4.8% out to 2025. Of all machinery producers, conveyor manufacturers were by far the largest market for geared products in 2020, providing an estimated 24% of total revenues. Sales to this sector are expected to see above-average growth out to 2025, with a CAGR of 6.8%, the drivers being the logistics and factory automation sectors.

Where end-user industries are concerned, food and beverage came in at number one, with 14% of revenues. But revenues from the sector will grow with a below average CAGR of 4.4% through the forecast period, while the warehouse and parcel sector is expected to achieve an impressive CAGR of 10.4%, as it benefits from the changes to consumer buying habits accelerated by the COVID-19 pandemic, which is causing a spike in demand for automated solutions.

– This originally appeared on Interact Analysis’ website. Interact Analysis is a CFE Media and Technology content partner. Edited by Chris Vavra, web content manager, Control Engineering, CFE Media and Technology, [email protected].