In the future, all materials scientists and chemical manufacturing companies will have access to machine learning tools to enhance their R&D.

In the future, all materials scientists and chemical manufacturing companies will have access to machine learning tools to enhance their R&D. Seamlessly integrating these underlying operations will not happen quickly, but overlooking the developments in materials informatics will lead to a loss of any competitive advantage.

Materials informatics (MI) is data-centric approaches to materials science and certain chemistry R&D. There is little doubt that this will be a common method in a research scientist toolkit, and rather than grabbing the headlines, some form of MI techniques will be assumed in all developments. The key to MI is around the integration, implementation, and manipulation of data infrastructures as well as machine learning approaches designed for chemical and materials datasets.

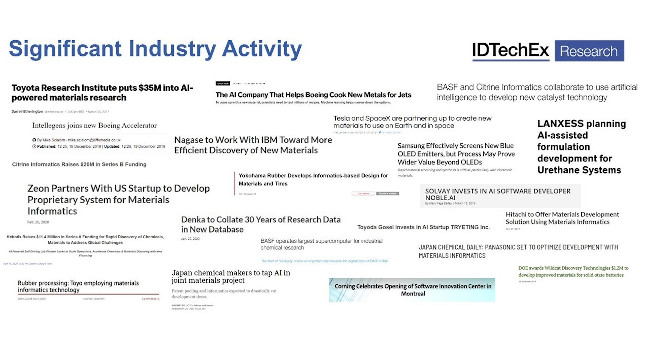

There is a large amount of evidence for this, but the best comes from how the industry are responding. There has been a large amount of activity over recent years, including partnerships, investments, and announcements from some of the most notable chemical and materials companies; this is outlined in the image below, showing a snapshot of these headlines.

The machine learning itself can be used in multiple different projects from finding new structure-property relationships, proposing new candidates or process conditions, reducing the number of expensive and time-consuming computer simulations, and more.

The ML approaches can take numerous forms of supervised and unsupervised learning methods; generative models can be effective at screening for optimized outputs across organic compounds while even simple modified random forest models can be useful for proposing follow-on reactions to meet a desired set of criteria. This is still at an early stage with a lot more development required; much can be leveraged from existing developments in AI but integrating specialist domain knowledge and coping with the unique challenges of a materials dataset is essential.

The application space is broad, and studies have shown success ranging from organometallics, thermoelectrics, nanomaterials, and ceramics through to many more. This article will highlight 4 areas of note that MI is already impacting. IDTechEx covers a large number of the relevant application areas, information on these are included in the market report to contextualize the significance of these MI-enabled R&D projects.

Soft materials is a loose term that spans a wide range of foams, lubricants, adhesives, polymers, and more. It is this area where materials informatics will see the earliest success. With a large list of feedstock combinations and process conditions, these formulations are excellent considerations for MI to be employed.

For most applications, there are comparatively few barriers to entry, and the properties can be physical (viscosity, tensile strength, glass temperature, etc) through to other considerations such as toxicity, cost, and in the supply chain. Nearly all MI companies have clients in this field, polyurethanes and epoxy resins are the most typically explored but the potential here alone is significant.

Additive manufacturing is an area rapidly embracing MI approaches for both polymer and metallic materials. This is a rapidly emerging technology and IDTechEx forecast that the materials will be the dominant source of annual revenue. Many have leveraged existing materials for the processes, but developing feedstocks bespoke for the unique processes can help unlock the full potential of this sector.

There is a large interest in metals, in particular, QuesTek Innovations, Intellegens, Exponential Technologies, and Citrine Informatics have all been active in this field, with the latter working with HRL Laboratories to produce an AM aluminum alloy registered by the Aluminium Association. As well as offering platforms and research projects many also use these advanced R&D approaches to build IP portfolios. OxMet Technologies carry this out for multiple alloys, particularly high-temperature nickel-superalloys, and Phaseshift Technologies target amorphous alloys using the fast cooling rate of the printing process.

IDTechEx have notable technical market reports in the field of additive manufacturing including a new report, “Metal Additive Manufacturing 2020-2030”, that provides granular forecasts by technology, application, material, and geography with detailed player profiles. Despite an inevitable fall, due to the COVID-19 pandemic, this market is forecast to exceed $10 billion within the next decade.

Energy storage is one of the main areas of R&D spending across science and engineering companies. The upcoming boom in electric vehicles (on land, sea, and air) as well as in opportunities like stationary energy storage means that nearly everyone is looking to get involved. Some may be losing their market as internal combustion engines are displaced and others may be seeing the opportunity to engage with a previously inaccessible lucrative sector.

Fundamentally, most of the energy storage developments are at the material level. From advanced cathodes and anodes through to solid-state electrolytes and beyond. There are numerous considerations in terms of thermal stability, potential, cycle life, and capacity not to mention how those materials are deposited and processed as well as economic and supply chain considerations. This makes it a prime area for materials informatics and is already highly evident with Toyota Research Institute, Samsung, Saft and more actively exploring this field.

Organic electronics is another exciting area that covers a wide range of sectors and includes attractive features such as simple processing, substrate compatibility, a tunability. This has found applications in displays, sensors, photovoltaics, and so much more spanning numerous verticals with a market potential to exceed $40 billion within the next decade.

Materials informatics also has an opportunity here and is being exploited. From Samsung looking at OTFT and OPV candidates, to Panasonic investigate heteroacenes with appropriate charge mobility, and Kebotix exploring electrochromics for smart windows. There is a huge potential in this field waiting to be further explored.

– Edited from an IDTechEx press release by CFE Media.