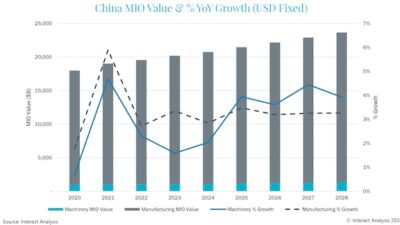

Manufacturing index reaches lowest point in 10 years as new orders, production and employment contracts amid economic concerns.

Economic activity in the manufacturing sector contracted in December as the purchasing managers index (PMI) dropped to 47.2, which is a drop of almost 10 points compared to January 2019. While the overall economy grew for the 128th consecutive month, the decline remains a major concern.

The report was issued today by Timothy R. Fiore, CPSM, C.P.M., chair of the Institute for Supply Management (ISM) Manufacturing Business Survey Committee, said in a press release: “December was the fifth consecutive month of PMI contraction, at a faster rate compared to the prior month. Demand contracted, with the new orders index contracting faster, the customers’ inventories index remaining at `too low’ status and the backlog of orders index contracting for the eighth straight month.”

Of the 18 manufacturing industries, three reported growth in December: food, beverage & tobacco products; miscellaneous manufacturing; and computer & electronic products.

“Global trade remains the most significant cross-industry issue, but there are signs that several industry sectors will improve as a result of the phase-one trade agreement between the U.S. and China. Among the six big industry sectors, Food, Beverage & Tobacco Products remains the strongest, while Transportation Equipment is the weakest. Overall, sentiment this month is marginally positive regarding near-term growth,” Fiore said.

What respondents are saying

- “Backlog of orders is shrinking due to new order pace continuing to fall.” (Computer & electronic products)

- “Due to sluggish sales, we have introduced promotions to generate increased sales.” (Chemical products)

- “Cautiously optimistic is the rule these days. Sales are decent, but we’re wondering what 2020 will bring. Still hedging that it will be successful — but maybe not as much as this year.” (Transportation equipment)

- “Starting to see suppliers try to pass on costs associated with tariffs. Uncertainty on the trade front continues to keep agricultural markets on the defensive.” (Food, beverage & tobacco Products)

- “Down month-to-month, but up over last year.” (Miscellaneous manufacturing)

- “Anticipated large export orders did not materialize. As a result, expected U.S. production has decreased.” (Fabricated metal products)

- “Dealer inventories have rebounded, and overall customer market has softened, resulting in corrections to near-term production schedules and a tentative forecast outlook.” (Machinery)

- “Export markets continue to weaken for plastic resins — Mexican producers are actually trying to sell product back into the U.S. due to weak in-country demand.” (Plastics & rubber products)

- “Our outlook for the first quarter of 2020 is positive. We have secured contracts from a number of former customers and expect sales growth of about 5 percent over Q4 of 2019.” (Textile mills)

- “The construction market seems to have slowed for end of year. Overall, it’s marginally up.” (Nonmetallic mineral products)