A panoply of solutions powered by artificial intelligence.

Digital transformation is the world’s change catalyst. It empowers millions of people, while facilitating value creation opportunities.

The internet economy enables ecommerce, fintech, and insurtech, to name a few. Yet while these emerging sectors capture eyeballs, a closer look at the world’s leading corporations reveals that more conventional economic sectors dominate the global economy.

In fact, the productivity of leading oil & gas companies outscore the gross domestic product (GDP) of many smaller nations.

Size or scale doesn’t guarantee profits. The oil & gas industry is grappling with issues that cast a shadow over future prospects. For instance, the recent oil price plunge caught many companies on the wrong foot.

Media reports that nearly 70 key oil & gas enterprises are struggling through bankruptcy with a staggering $34.3 billion in debt. It’s feared that nearly 175 more corporations are on the brink of bankruptcy. Experts suggest the industry is only halfway through the crisis. In 2019, oil & gas defaults will amount to approximately $70 billion, alongside $400 billion in debts.

This is a grim scenario for a sector that pioneered technology advances in the 1980’s and 1990’s before phrases like Big Data, analytics, and the Industrial Internet of Things (IIoT) became common parlance. At that point, oil companies were already implementing 3-D seismic, linear program modeling, and advanced processes.

However, developments did not continue apace, and the sector, overall, has not progressed as expected. It is time for a second period of technology advance that could further reduce costs, increase productivity, and boost the oil & gas company performance significantly.

For many companies, the natural course of action was to explore digitalization, Big Data analytics, and artificial intelligence (AI) technologies to weather low oil prices and navigate the volatile industry scenario. Moving forward, as the United States becomes a net natural gas exporter the industry will need to further sharpen efficiency, as well as exploration capabilities.

Analytics in the equation

In the past, US-based oil & gas companies used just about 1% of recorded sensor data in decision-making. Organizations did not have the tools and capabilities to maximize production capacity, leading to industry-wide inefficiencies that amounted up to $200 billion annually. Conventional SCADA systems, outdated simulation tools, and untrained crew members struggled with the complexities of production and performance assessment.

One reason is the large, unused volumes of unstructured data generated from installed sensors. One U.S.-based independent oil producer estimated it uses only 5% of the terabytes of seismic data already available. Things will improve once the industry uses digital asset management technologies and Big Data analytics as complements to the “new normal” for oil prices. Such technologies facilitate structured data storage, categorization, analysis, and application.

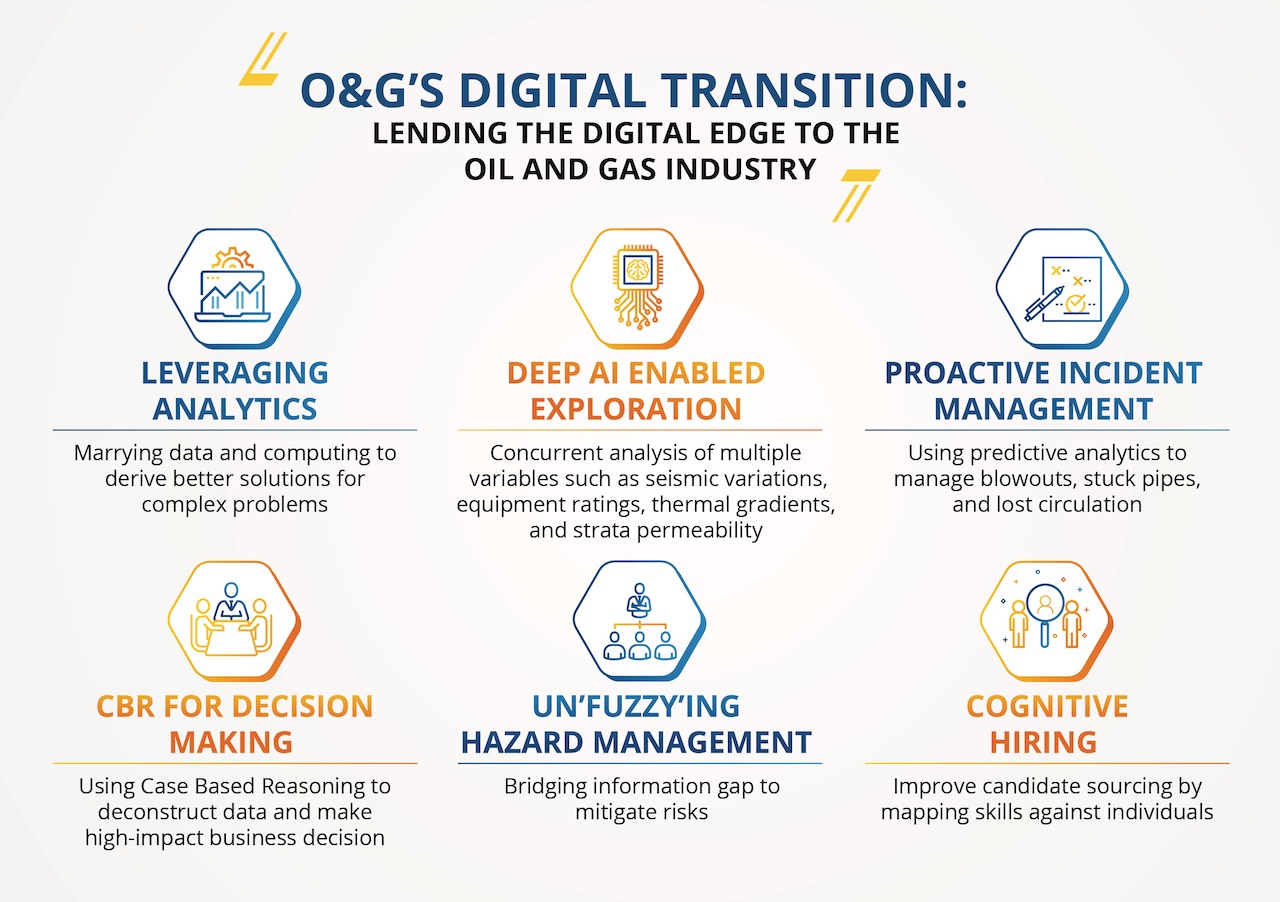

The idea is to combine data science and computing power with sensor-captured data to derive better solutions for complex problems. Statistical methods are used to plot large masses of data. Machine learning algorithms layer information pertaining to multiple variables. Patterns are rapidly identified that otherwise might escape the most trained human eye or prove extremely time-consuming. For example, the pressure differential existing in a reservoir can be monitored in real time without human intervention.

Combating the crisis

Through machine learning applications, oil & gas companies can concurrently analyze multiple variables such as seismic variations, equipment ratings, thermal gradients, and strata permeability. The data, once layered, helps identify drill direction, penetration rate, and control parameters. The capability of AI-based algorithms to identify noise in seismic data can reduce wellhead development costs by 10%, Similarly, machine learning applied to equipment data can help preempt events such as blowouts, stuck pipes, or lost circulation.

Apart from machine learning, another element of AI, known as case-based reasoning (CBR), has captured the industry’s attention. This process scans through data related to documented problem cases, identifying patterns and similar issue instances. When such cases are found, the data is deconstructed and deeper analysis is conducted to ascertain the steps that were taken to rectify the situation. While this strategy is extensively used in the drilling space to help operators deal with oil exploration issues, it is beginning to find acceptance in other areas too, particularly in making high-impact decisions.

When information is incomplete or unreliable, fuzzy logic, another AI-based technique, takes precedence. The approach is effective when information gaps exist for reservoir characterization and several variable input parameters are at play. Fuzzy logic can be used for risk-based inspection to measure hazard risk in several dimensions.

Cognitive knowledge platforms have found a place with some leading-edge companies. Oil & gas enterprises leverage these tools to improve candidate sourcing, extracting information from talent sourcing channels and pre-existing social data. Cognitive technologies have more to offer than simply the support of oil-rig operations. For example, the recruitment decisions thus taken are based on skills apart from experience, potentially transforming traditional talent acquisition norms. In general, these technologies allow engineers to accelerate the process of identifying problems and finding resolutions.

Using AI optimally

Adoption of digital technologies in oil & gas has grown at a pace never witnessed before. However, the picture is not as rosy considering many companies are still struggling to break away from the practice of working with siloed information.

These laggards must realize decision makers need the information made available through solutions such as predictive analytics and machine learning,

The oil & gas industry is now beginning to pay heed and a consensus appears to be emerging that the sector is on the cusp of a new age powered by digital technologies. This transformative wave will reshape economic, industry, and technology trends. Organizations will need to deep dive into a management-driven digital strategy. It also will require committed investments for revamping existing infrastructure and systems as well as human resources. All of these will act as enablers for a successful transformation of the oil & gas industry.

Subrat Tripathy is chief business officer, North America, L&T Technology Services.