Pressure on the economy has contributed to a downward trend in global manufacturing output growth according to an Interact Analysis report.

Global Manufacturing Insights

- Europe’s 2022 manufacturing output growth to be 7% less than 2021 due to COVID-19’s impact on operations.

- Semiconductor and electronics machinery growth forecast at 6.2% in 2022, which is an outlier in the manufacturing industry.

- UK & Italian growth revised down compared to last quarter.

Research from Interact Analysis points to a slow year for global manufacturing output, with growth of 3.9% expected in 2022 because of many pressures on the economy, including inflation and the war in Ukraine. Europe will be particularly slow, with a growth projection for manufacturing of 3.7% which is down from 2021’s 11.4% figure.

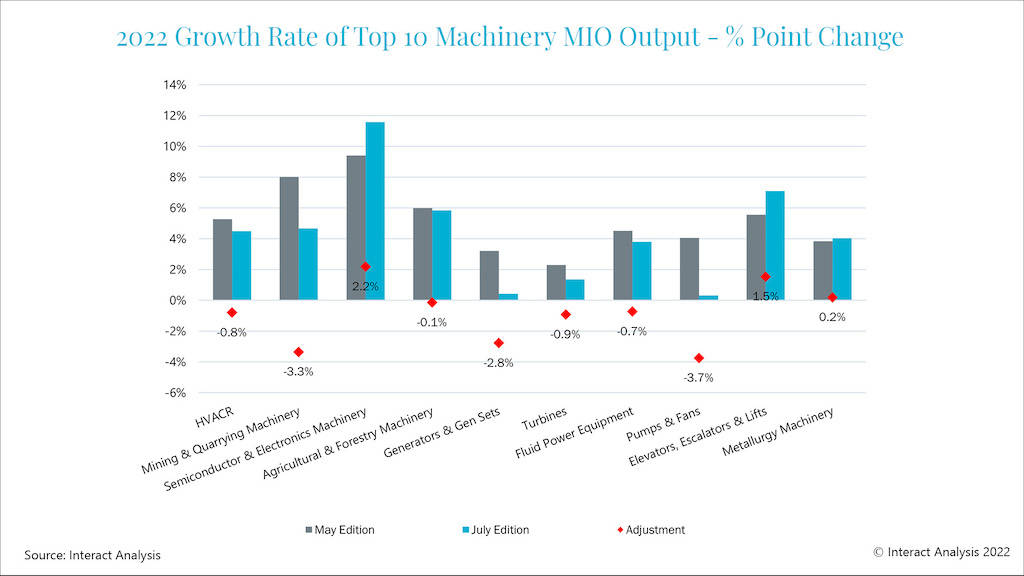

The manufacturing machinery forecast is far less optimistic than the previous quarter, with eight of the top 10 sectors experiencing a downward revision of their forecast for 2022. Semiconductor and electronics machinery bucked the trend, and is forecast for 6.2% growth in the year. However, such growth is likely to be unsustainable in the context of the boom-bust market for semiconductors. A downturn is projected for 2023. Japan is the largest single supplier of semiconductor and electronics machinery, accounting for 30% of the total market, with China at 23%, the US at 10% and The Netherlands at 7%.

Another machinery sector with a decent projected performance for 2022 is machine tools. Machine tools is a small niche of the wider machinery market, but it plays an essential role in several of the largest manufacturing sectors such as automotive and metals. Following a very strong 2021, machine tools are projected for 5% growth this year, and solid continued growth is projected out until 2026.

From a regional perspective, the two most obvious negative occurrences are a revision down of performance for Italy and the UK in this quarter compared to last quarter. Most UK manufacturing sectors are struggling. Overall, in 2022, the UK is expected to show 2% growth in manufacturing output. Meanwhile, Italy will hit 3% growth for 2022 and, despite its poor performance this quarter, is expected to keep growing until 2026.

Tim Dawson, senior research director at Interact Analysis, said, “World events are playing an outsized role in terms of their impact on manufacturing. In particular, inflation has caused severe problems by increasing input costs for energy, raw materials and components. In the U.S., a strong dollar is damaging the competitiveness of manufacturing exporters. Meanwhile, China is far less badly impacted by inflation, with a rate of just under 3% (compared to 9% in the U.S.).

“The topic of reshoring or near-shoring of manufacturing is much discussed in the global business press. One clear present-day move in this direction is the United States’ CHIPS Act which is investing $52 billion in U.S. semiconductor manufacturing. The Chinese response is not yet clear, but the CHIPS Act is likely to prove effective in its primary goal of reducing U.S. dependence on China since of the top 10 semiconductor companies, six are U.S. and none are Chinese. The likely result is a significant shift of semiconductor manufacturing to the U.S. in the mid to long-term.”

– Edited from an Interact Analysis press release by CFE Media and Technology. Interact Analysis is a CFE Media and Technology content partner.