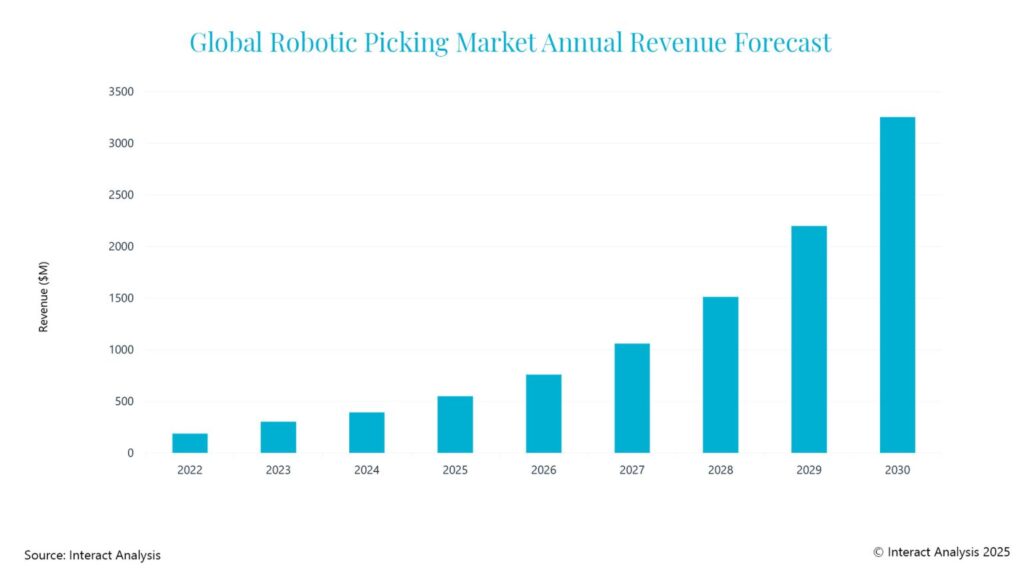

In December 2024, Interact Analysis unveiled annual Robotic Picking Report, offering a comprehensive analysis of industry dynamics and key trends.

Physical manipulation is seen as key challenge for warehouse automation. Approximately 50% of the labor costs associated with a manual e-commerce warehouse is spent on picking. Robotic picking systems are used to manipulate items, including packages, cases, and eaches, connecting one workflow to another. For example, bin-to-bin picking robots pick items from a storage tote and place them into a delivery tote, whilst a mixed case depalletizing robot picks cases from a pallet and places them onto a conveyor belt, ready for the next step in the warehousing process.

Until recently, robotic picking systems were seen as an emerging technology, limited by machine vision, gripping technology, and affordable robots. However, in recent years, notable improvements have been made in all these three categories, which are expected to drive growth in the mid- to long-term. Globally, the annual revenue of the robotic picking market reached $393 million in 2024. By 2030, the market is forecast to grow to $3.3 billion, with a CAGR of 42% between 2024 and 2030. In 2024, just over 3,000 units of picking robots were shipped globally (excluding sales to Amazon), and this number is forecast to increase to nearly 27,000 in 2030 (excluding Amazon).

However, while there is optimism about long-term growth, a number of factors are preventing widespread adoption.

After a five-month research period and over 30 in-depth interviews with vendors and end customers, forecasts have been revised downward from earlier analysis. During this process, six key trends were uncovered that are expected to impact the demand for robotic picking in both the medium and long term.

1) Supplier Instability and Customer Caution

The financial health of suppliers significantly influences robotic picking adoption. Many customers, recalling Amazon’s acquisition of Kiva and its impact on Kiva’s customers, are wary of vendors that could face financial instability or be absorbed by larger firms. This caution, heightened by Amazon’s quasi-acquisition of Covariant, is extending sales cycles and slowing market growth. Several robotic picking companies have reported that their customers are placing far greater scrutiny on their financial health, which is extending the sales cycle and restraining demand.

2) Economic Slowdown and Global Challenges

Economic factors such as high interest rates, reduced warehouse construction, and China’s economic slowdown are reducing demand for robotic picking. Budget constraints and fewer new automation projects are pushing businesses to delay automation investments, underscoring the market’s sensitivity to external conditions.

3) Declining Interest in Robotics-as-a-Service (RaaS)

Once seen as a significant innovation, RaaS adoption has declined, with companies favoring CapEx models for greater asset control and long-term cost efficiency. While RaaS remains viable in niche scenarios, it faces adoption challenges compared to CapEx models. Companies which focus exclusively on RaaS models may struggle to gain traction, given the faster growth of CapEx models.

4) Faster Adoption of Case Picking Over Each Picking

Case picking is advancing more rapidly than each picking as automation efforts focus on upstream distribution centers, where pallets and cases dominate. Although each picking’s complexity slows its adoption, its long-term potential suggests strong future growth. Each robotic picking company tends to focus on specific workflows. Knowing which workflows will lead to the highest long-term demand is crucial for defining a company’s strategy.

5) Stable Pricing amid Market Competition

Pricing for robotic picking solutions remained steady through 2023 and 2024, despite the entry of low-cost Chinese competitors and growing similarity between solutions. This price stability indicates a balanced market dynamic and technological maturity. Prices are expected to decrease to encourage broader adoption. As a result, higher prices may constraint short-term demand.

6) Growth of Pure-Play Software Providers

The value chain is increasingly segmented, with pure-play software providers like Siemens and Fizyr are expanding their market presence. These companies focus solely on software, leaving hardware and integration to others. This trend indicates increasing specialization, and with fewer firms expected to offer end-to-end solutions, covering both hardware and software in the long term.

Final Thoughts

The robotic picking market is facing challenges such as supplier uncertainty, economic headwinds, and RaaS hesitancy. However, rising trends in case picking, software specialization, and market collaboration indicate point to continued growth potential. Adaptability and innovation will be vital as the industry continues to evolve, driving the evolution of warehouse automation.

For more information about the Robotic Picking report, download the report brochure.

Edited by Puja Mitra, WTWH Media, for Control Engineering, from an Interact Analysis news release.