While acknowledging that it’s not the first vendor to leverage the model, SAP claims its new SaaS offering is groundbreaking nonetheless because it blends both front office customer relationship management (CRM) and back office ERP capabilities within the context of integrated business processes.

While acknowledging that it’s not the first vendor to leverage the model, SAP claims its new

SaaS

offering is groundbreaking nonetheless because it blends both front office customer relationship management (CRM) and back office ERP capabilities within the context of integrated business processes.

“It’s a complete solution,” said SAP CEO Henning Kagermann, at last week’s launch event for SAP Business ByDesign. “We have not designed it with traditional [application] categories in mind. From the beginning, the idea was to design it for end-to-end, flexible, adaptable, business processes within a company and beyond the boundaries of a company.”

The new offering targets companies with 100 to 500 employees. SAP claims 20 customers already are live on the solution, and its goal is to have 10,000 companies on the platform by 2010.

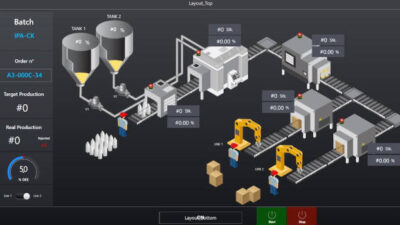

During a demonstration of the software, SAP executives showed how users would access configurable roles-based screens that handle tasks such as quotation management. The screens showed how traditional back-office information—such as real-time inventory levels needed for order promising—were immediately visible within such customer-facing processes.

Kevin Flanagan, CEO of Compass Pharma Services, a Clifton, N.J.-based provider of contract manufacturing and packaging services to the pharmaceuticals industry, said this front-to-back business process integration was a key reason it chose to become one of the early customers for Business ByDesign, though it also helped that SAP systems are widely used in the pharmaceutical industry. “We had a lot of familiarity with SAP due to the fact that all our purchase orders and work orders are received from SAP environments,” Flanagan said. “This [industry acceptance of SAP] weighed in our decision, but the most critical factor for us was the fact that we now had an integrated solution.”

SAP estimates that there are about 1.2 million midmarket companies worldwide that need a comprehensive business suite, but have been reluctant to purchase a solution due to high cost of ownership under traditional application delivery models. By gaining at least 10,000 of these companies as customers for Business ByDesign by 2010, SAP is betting the new solution will help it reach its goal of 100,000 total customers by that same year.

SAP will continue to sell two other solution sets into the small and medium business (SMB) market. Its SAP Business One—which Kagermann said has been sold about 15,000 times—targets companies with fewer than 100 employees, while its SAP Business All-In-One solution—which already has 10,000 installations—targets companies with 100 to 2,500 employees. Kagermann said All-in-One—which is based on SAP’s main ERP suite—appeals to larger midmarket companies that need “micro-vertical” industry functionality that has been built into various industry versions of the product.

At the launch event, Leo Apotheker, SAP’s deputy CEO, rejected the notion that Business ByDesign will “cannibalize” the existing solution sets. Business ByDesign, he said, will appeal to fast-growing midmarket companies that are interested in a comprehensive SaaS solution to help them quickly collaborate as part of networks. Any overlap in market appeal with Business All-In-One or Business One, he adds, “will be so small as to be irrelevant.”

Peter Zenke, a SAP executive board member who was key in leading development of the new solution, says SAP has had 1,000 developers working on its SaaS offering over a period of four years, at a total investment of between $300 million and $400 million Euros. Much of the focus, says Zenke, was on coming up with an intuitive, easy-to-configure user interface, but developers also were tasked with blending SAP’s enterprise service-oriented architecture with SaaS.

Other vendors already are established in the SaaS market, perhaps most notably, Salesforce.com , which has 35,500 customers for its CRM solution. NetSuite and Glovia Services offer enterprise-level SaaS solutions. NetSuite offers CRM, ERP, and some logistics execution functionality in a solution being used by 5,300 companies.

“We welcome SAP to the SaaS party, so to speak,” says Craig Sullivan, a VP with NetSuite, “but we think they are going to find some significant challenges with companies in this market segment who are concerned about solution costs.”

At the same time, says Sullivan, NetSuite believes SAP’s move validates the concept of a comprehensive SaaS-delivered suite for SMBs. Sullivan says that Larry Ellison, CEO and founder of SAP’s arch-rival Oracle , as well as majority owner of NetSuite, has stated that Oracle was not hurt when IBM , a much larger rival, entered the relational database market after Oracle had pioneered the technology. Instead, Ellison believes IBM’s entry into the market boosted Oracle’s case for relational database technology, and

SAP will work with channel partners to sell, configure, and run Business ByDesign for customers, though initially, all the hosting will be done by SAP, and SAP’s direct sales force will conduct early sales efforts to help build demand for the solution. Also, the solution is not yet generally available worldwide, though it can be purchased by selected early customers in the U.S.,

So while SAP is quick to point out the considerable resources and ambitious goals involved in what Kagermann called a “new era” for SAP, some observers say the market impact will take time to unfold. “The product launch announcement is only the first step in a lengthy ramp-up process, and much work remains to refine the product and go-to-market strategies,” says Paul Hamerman, a VP with analyst firm Forrester Research , Cambridge, Mass.