Mobile robot adoption is growing across different industries, but the pace and level varies and customer demands differ, as well.

Mobile robot insights

- Mobile robot adoption is increasing across industries, with larger companies and manufacturers leading the way, but challenges like cost and integration hinder broader usage.

- Customers use multiple robot brands, valuing ROI and smooth implementation, preferring brands with strong track records and local support, but showing little loyalty to a single brand.

Mobile robots have become an essential part of the automation landscape, offering flexibility, scalability, and efficiency to various industries and applications. But what do customers really want from mobile robots, and how do they evaluate and select different technologies and vendors? To answer these questions, we conducted a global survey of 300 buyers and users of mobile robots, covering different company sizes, sectors, and regions. The survey aimed to understand the current and future adoption of mobile robots, the factors that influence purchasing decisions, and the pain points and benefits of using mobile automation.

Mobile robot adoption is growing, but not evenly

The survey revealed that mobile robot adoption is growing across different industries, but not at the same pace or level in each sector. Most respondents (59%) indicated they already use some form of mobile automation in their facilities, such as automated forklifts, platforms, conveyors, or autonomous mobile robots (AMRs).

However, this proportion varied significantly by company size and sector. Larger companies (with revenues over $1 billion) were more likely to use mobile robots than smaller ones, and manufacturers – especially in the automotive, electrical, and semiconductor sectors – were more likely to use mobile robots than retailers, 3PLs, or other industries. Moreover, most respondents (71%) said that they only partially automated their workflows with mobile robots, indicating there is still room for improvement and expansion of mobile automation.

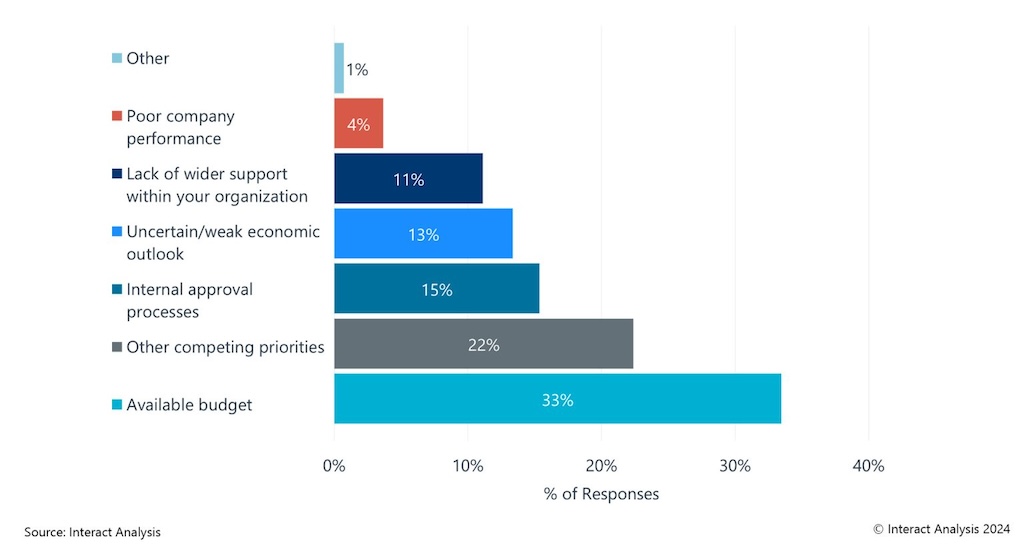

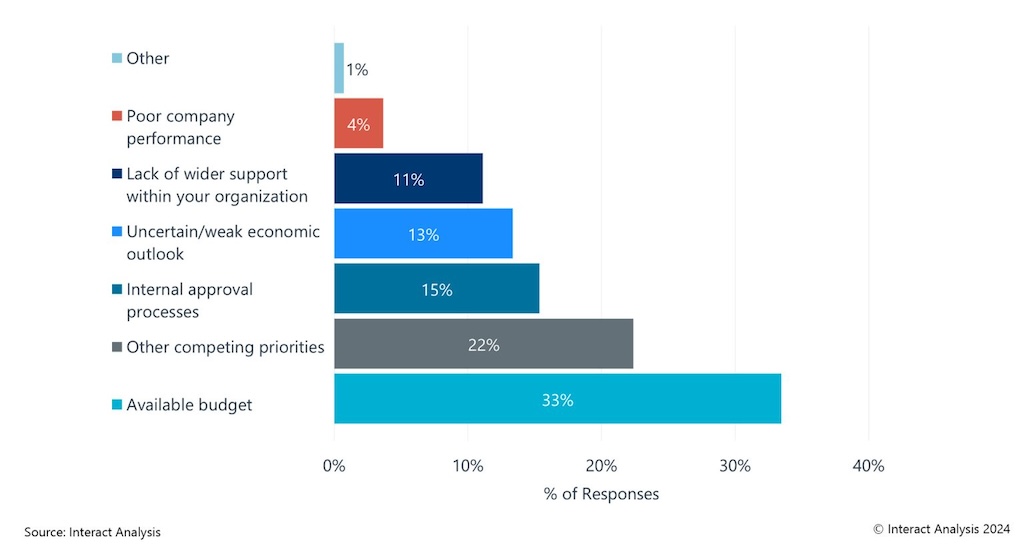

Cost and integration challenges are the main barriers and drivers of mobile robot adoption

The survey also revealed that cost and integration difficulties are the main barriers and drivers of mobile robot adoption, and that these were two major factors for both technology and vendor selection. The most common reason for not using mobile robots was the high price or perceived lack of return on investment (ROI), followed by environmental factors such as floor suitability, space constraints, or climate. The most common reason for needing to automate was the desire to reduce operating costs, followed by the need to improve reliability and accuracy (and surprisingly not because of a lack of labor). When selecting a technology for an automation project, the lowest lifetime cost and the ease/speed of integration were the most important factors, followed by system flexibility and performance.

Customers are not loyal to one mobile robot brand or type

The survey also showed that customers are not loyal to one mobile robot brand or type, but rather use multiple brands and types for different workflows and facilities. On average, respondents used 3.4 different mobile robot brands, and 123 different brands were mentioned in total, reflecting the fragmentation and diversity of the market. ABB was the most mentioned brand, followed by Omron, Kuka, and Locus Robotics. However, when asked which brand they consider best in class, the answers varied by industry and application, and we will reveal those results at a later date!

Customers also indicated they prefer to use the same mobile robot brand across different workflows in the same building, but not necessarily across different buildings or facilities in their network. This suggests customers care little about robot interoperability within a facility. When selecting a vendor, the most important factors were the vendor’s track record, integration expertise, and local/on-site support, followed by the stability and size of the vendor. Price and product range were less important than the vendor’s reputation and service.

Customers expect a quick ROI and a smooth implementation process from mobile robots

The survey also indicated customers expect a quick ROI and smooth implementation from mobile robots, and that they measure the success of mobile robot implementation by a variety of different metrics. Most respondents (80%) expected an ROI within three years, with most of those expecting it between 18 months and three years. 3PLs typically expected a quicker ROI than other sectors. The most common metrics used to measure the success of mobile robot implementation were ROI, productivity, throughput, accuracy, and cost reduction.

Prior to making a final purchasing decision, customers also expected to see the automation system in action, either through an in-house demo, a reference site visit, or a visit to the supplier’s demo center. During the purchasing and implementation process, the most common pain points were operation slowdowns, routing and tasking difficulties, and problems with integrating with internal software. Once a robot was operational, the most common pain points were lack of maintenance prediction, costly downtime, and too much manual intervention required.

Customers are interested in AI, but not in VDA5050 or Chinese vendors

The survey also revealed some interesting insights into emerging technologies and trends in mobile robotics that customers find relevant or interesting. AI was the most commonly mentioned emerging technology trend that customers were interested in (specifically when it came to mobile automation). Surprisingly, customers were not very familiar with the VDA5050 standard. VDA5050 is a standard for communication and interoperability between mobile robots and fleet managers developed by the German Association of the Automotive Industry (VDA).

However, only 20% of respondents said they were fully aware of it, and only 8% said it was or would soon be a mandatory requirement in their purchasing decisions. Likewise, Chinese vendors were not very popular among customers, with only 20% of respondents saying they had used or would consider using them in the future. The most common reasons for not considering Chinese vendors were security concerns, performance issues, safety issues and legal reasons.

The survey showed customers have high expectations and diverse needs when it comes to mobile robotics. Customers value ROI, productivity, throughput, accuracy, and cost reduction as the main metrics of success, and they want to see the automation system in action before buying. They also face various challenges during and after the implementation process, such as operation slowdowns, routing and tasking difficulties, integration issues, maintenance prediction, downtime, and manual intervention. The survey provides valuable insights for mobile robot suppliers and integrators who want to better understand and serve their customers.

– Interact Analysis is a content partner.