Smart sensors and machine learning algorithms detect anomalies in industrial machines, and as algorithms become better trained, software can accurately predict when machines with industrial automation is at risk of failure. New business models for machine as a service (MaaS) may help overcome slow adoption of predictive maintenance technologies.

Learning Objectives

- Predictive maintenance and machine as a service can optimize revenue for the OEM and customer.

- Smart sensors, machine monitoring, and machine learning help predictive maintenance.

- Smarter pricing and data models help machine as a service (MaaS).

A predictive maintenance elephant is in the room – manufacturing equipment producers make money when industrial machines break. While it is in the best interest of users to extend the working life of industrial equipment and ensure their manufacturing lines do not experience unplanned downtime, original equipment manufacturers (OEMs) lose replacement revenue the longer a piece of equipment is in commission. This conflict of interest between supplier and customer always has existed.

How do equipment manufacturers maintain profitability with the advent of predictive maintenance technologies without cannibalizing revenue streams brought by replacement industrial equipment and service contracts?

Predictive maintenance sensors, monitoring, software

Predictive maintenance technologies include industrial automation products: smart sensors (vibration sensors, temperature sensors, and others), portable monitoring devices, dedicated predictive maintenance software, and gateways dedicated for predictive maintenance functions. Industrial automation hardware measures the performance of equipment by collecting data on measurements, such as smart sensors for machine vibration and machine temperature. The software then applies machine learning algorithms to detect anomalies within these readings. Over time, as these algorithms become better trained by the vibration sensors and temperature sensors, the software can better predict when a piece of industrial equipment is at risk of failure.

Smart sensors help enable predictive maintenance

While the concept of condition monitoring has been around for some time, the market for more sophisticated predictive maintenance products is still very young. Smart sensors, an enabling product for predictive maintenance growth, became mainstream in 2016 when ABB launched its ABB Ability Smart Sensor at Hannover Messe to an audience including President Barack Obama and German Chancellor Angela Merkel.

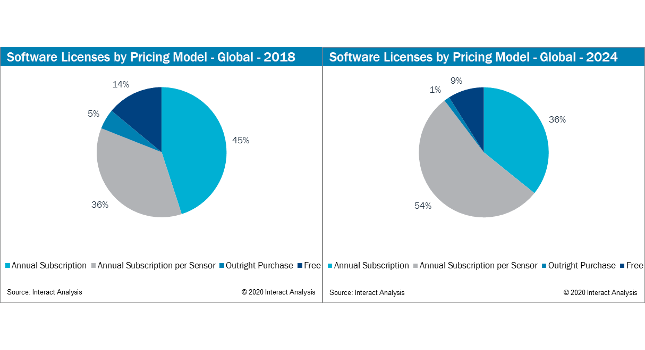

Most predictive maintenance solutions are sold on a per unit basis, with suppliers typically charging an annual or monthly price per sensor, which provides access to dedicated software used to perform analyses. As the figure shows, this pricing method will continue to grow, but it does not directly address the conflict of interest between machinery supplier and machinery user.

Machine as a service improves machine performance

Changes in the use of these technologies can address this conflict of interest, and this approach will be a major trend for future predictive maintenance technology implementations.

The concept is called machine as a service (MaaS). This approach takes the model for software as a service (SaaS), rethinks pricing, and applies it to machinery. Instead of pricing the solution as an annual subscription, it prices based on performance. Goals around key performance indicators (KPIs) are agreed upon between the customer and supplier; the price of the contract is determined by the extent to which these goals are met.

For example, Pearson Packaging, offers various types of packaging machines under this model. Instead of selling the machine outright, Pearson retains ownership and charges the customer based on the number of cases palletized, erected or sealed. With this approach, the machine builder is incentivized to keep the machine running as long as possible and with as much uptime as possible – two areas which are addressed directly by predictive maintenance technology.

Barriers to predictive maintenance adoption

Industrial data ownership is one barrier to predictive maintenance adoption the MaaS model helps overcome. Data ownership is a key discussion point between users of predictive maintenance solutions and industrial automation or original equipment manufacturer (OEM) suppliers.

Research shows manufacturers are generally conservative when it comes to sharing the operational data of its plants because data could be used by a malicious party to glean trade secrets or operational information not publicly available. Manufacturers in Europe tend to be the most sensitive about sharing this data, followed by the U.S., with the APAC region being the least sensitive.

Suppliers of predictive maintenance offerings will often commercialize data indirectly by using it to improve the capabilities of their products. (More data leads to better-trained algorithms.)

However, there are fears predictive maintenance suppliers will employ more direct methods of commercializing the data by selling it to big data brokers or selling applications which allow customers to generate their own insight into trends within real-world operational data. The ability of predictive maintenance providers to sell operational data leads to safeguarding by customers.

As with any agreement to share confidential information, the first decision point is often the most difficult for suppliers to overcome. MaaS doesn’t completely solve the data ownership concern; but since data must be shared for this model to function, we believe MaaS to be the “thin end of a wedge” needed for people to reach a level of comfort with sharing this type machine data. Aligning incentives between supplier and customer through the machinery as a service model puts the two on the same team, opens the door to cooperatively sharing data, and can optimize predictive maintenance for more effective machine operations.

Industrial services pricing models promote better maintenance

Motor equipment manufacturer SKF has an “as a service” model for bearings. The solution offering defined its pricing around reducing the historical rate of failure of bearings. Again, this type of model aligns the incentives of supplier and customer as now both parties have a vested interest in extending the life of the equipment rather than haggling over the price of bearings. (A related product is SKF Pulse, a portable Bluetooth sensor and mobile application to monitor rotating equipment.)

This type of model is certainly not “one size fits all.” For instance, the SKF model works well when selling to end-users. However, the question of “who pays what” gets more complex when selling to machine builders because the machine builder does not represent the end location of the equipment. This is not to say equipment manufacturers could not apply this model when selling to machine builders, only that additional negotiations would be needed to iron out the details of who monitors the bearing health at the machine’s final location. This model also requires a more active sales process due to the need to negotiate specific goals for each unique customer and will probably be suited for the most critical of applications. With all of this in mind, the reduced capital expenditure (CapEx) of the machinery and alignment of incentives make this model very attractive to manufacturers and is an effective way to differentiate an offering versus the competition.

How to improve predictive maintenance with machine as a service

MaaS models are likely to become more prevalent over time and the predictive maintenance market will substantially grow as a result. The value proposition of predictive maintenance is becoming too large to ignore, and with the recent advent of smart sensors and new innovative business models, this market is primed for rapid growth.

Blake Griffin is market research analyst, Interact Analysis. Edited by Mark T. Hoske, content manager, Control Engineering, CFE Media, [email protected].

KEYWORDS: Predictive maintenance, smart sensors, machine learning

CONSIDER THIS

Where’s the bottleneck for your predictive maintenance optimization – smart sensors, machine learning or pricing?