Manufacturers—like nearly everyone else in the business world—are looking forward to better times in 2010. Several recent surveys confirm that sentiment. For instance, 57 percent of the senior executives polled in the PricewaterhouseCoopers Manufacturing Barometer in the third quarter of 2009 expect their companies to experience revenue growth in 2010.

Manufacturers—like nearly everyone else in the business world—are looking forward to better times in 2010. Several recent surveys confirm that sentiment.

For instance, 57 percent of the senior executives polled in the PricewaterhouseCoopers Manufacturing Barometer in the third quarter of 2009 expect their companies to experience revenue growth in 2010. In addition, 48 percent of those executives expressed optimism about the prospects for the U.S. economy in 2010, with only 13 percent being pessimistic.

A similar survey conducted by ThomasNet, an operator of e-commerce platforms serving manufacturing companies, uncovered even greater optimism, with 76 percent of respondents saying they expect the U.S. economy to show improvement by the second quarter of 2010, and 35 percent expecting their own businesses to start growing even sooner.

The question is whether this optimism is based on solid evidence pointing to a real economic recovery, or if it’s merely the wishful thinking of people battered by what has been the most severe economic downturn of their lifetime.

Many recognized economic experts see the U.S. economy improving slightly in 2010, but they expect emerging markets like China and India to show more robust growth.

The global management consulting firm Booz & Co. recently cited projections from The International Monetary Fund (IMF) that global economic growth will hit 3.1 percent in 2010, with China growing at 9 percent and India 6.4 percent, while the U.S grows 1.5 percent, and Europe grows an even more modest 0.3 percent.

In his most recent testimony before the U.S. Congress, Federal Reserve Chairman Ben Bernanke said nothing to refute that outlook.

Bernanke said he already sees signs of customer demand strengthening, and that, along with the continued shrinking of inventories, should prompt an uptick in manufacturing activity in the coming year. But he also said that, given the current high unemployment rate (10 percent in December 2009), “we might be in for a so-called jobless recovery in which output increases but employment does not.”

Bernanke went on to say that, “in fact, productivity growth has recently been quite high, even as the economy was contracting. It’s likely that in many cases firms achieved their productivity gains by asking their remaining workers to provide extra effort.”

While people still holding jobs undoubtedly are taking on additional duties and putting in extra hours to keep companies going, Bernanke failed to mention one other essential factor contributing to increased productivity in the face of economic contraction: the growing use of information technology as a business tool.

As readers of Manufacturing Business Technology are well aware, the infusion of information systems into every phase of the business—from backoffice tasks like order processing to product development, manufacturing, and supply chain management—is not only making individual workers more productive; it’s also allowing entire companies to devise business processes that give them a competitive edge.

We expect more creative use of IT in 2010, as companies plot strategies for coping with still uncertain economic conditions. Following are some of the top trends that people who follow the manufacturing industry—including analysts and technology vendors—expect to see in 2010.

Restrained spending

Both consumers and businesses are expected to remain conservative when it comes to spending. This is directly attributable to lingering uncertainty about the direction of the overall economy. Consumers particularly are concerned about the prospect of the so-called jobless recovery.

“Although there is much speculation on the rate of the economic recovery, some indications suggest that consumers’ frugal spending behavior during the recession may last well into the recovery period and beyond,” notes David Johnston, senior VP, supply chain, JDA Software, a supplier of supply chain management solutions. “Given this situation, manufacturers should recalibrate their supply chains now to assist them in operating successfully in today’s ‘new normal’ and lay the groundwork for future growth.”

If companies and individuals indeed hold the line on spending that should trigger several other trends, starting with a new focus on managing inventory.

Inventory optimization

“Many manufacturers have cut inventories to the bone, hoping that they won’t end up with a huge write off because of soft demand,” says Noha Tahomy, VP supply chain research with AMR Research. “This has made supply chains more susceptible to disruptions, as inventory is typically used to mitigate risk. Because of that, companies are looking at inventory optimization, not to lower their inventories but to make sure that they are fulfilling customer service levels.”

While this new focus on proper inventory management no doubt will lead to more use of inventory optimization applications, Tahomy says that won’t necessarily lead to a new wave of spending on those solutions.

“After this downturn, all companies are being very conservative,” she says. “More than any other downturn, I have seen companies go back to their current supply chain management software investments and try to get more ROI out of them. I expect this trend to continue.”

Peter Scott, VP of supply chain solutions for Exostar, a supplier of applications for managing business-to-business processes, agrees that the downturn has manufacturers more concerned about supply chain risk, but he also senses a high level concern about not being prepared if the economy suddenly takes off—and that has companies looking to manage capacity as much as inventory.

“Manufacturers must ensure they have the capacity to compete effectively for new business,” Scott says. “Because the forthcoming recovery, unlike the majority of its predecessors, is anticipated to be largely jobless, capacity gains can’t be achieved by throwing more bodies at the problem. Instead, these gains will have to come from technology investments to automate processes and allow fewer people to work more efficiently, with capabilities such as exception and event management and improved reporting.”

Another area that’s likely to get more attention as manufacturers struggle to boost revenues in the face of restrained customer spending is…

Strategic pricing

As director of business consulting for Vendavo, a supplier of pricing optimization software, Derrick Herbst has an obvious interest in seeing more manufacturers adopt strategic pricing strategies. But numerous independent observers have confirmed Herbst’s assessment that learning to price products properly will become essential for manufacturers going forward.

“Many companies still view pricing as a tactical measure, done in an ad-hoc reactive manner,” Herbst says. “Companies need to get strategic about pricing by incorporating it into core company strategy and objectives.”

As Herbst points out, strategic pricing requires detailed analysis of numerous factors—including customer preferences, market conditions, material prices, and production costs—that can only be performed with sophisticated software. He also notes, however, that mastering the art of strategic pricing boosts profits by not only yielding better prices for products but also by discovering products—and customers—that are a drain on profits.

“Most companies have too many customers and products that not only drive down profits but also drain valuable resources,” Herbst says. “Performing an in-depth analysis of customer and product portfolios will help identify the outliers and inform corrective action—which includes eliminating unprofitable products and customers.” Of course, manufacturers’ desire to do all this will drive yet another trend…

Expansion of BI software and manufacturing intelligence

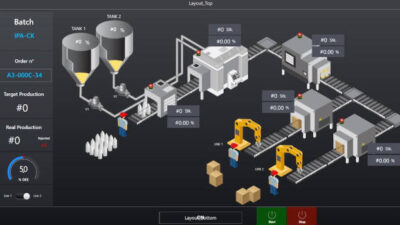

Business intelligence (BI) vendors have been promoting the use of their solutions for frontline office workers for several years. Now that quest has extended to include plant personnel, with both regular business intelligence vendors and suppliers of plant automation applications offering solutions for gathering and analyzing plant-level information.

Sean Duclaux, senior director of product management at AspenTech, a supplier of software for optimizing production in process-oriented industries such as pharmaceutical and chemicals, says there’s a reason plant-level vendors are developing what are known as manufacturing intelligence solutions.

“There’s a fundamental limitation with traditional BI in that these tools are historical or backward looking, from a plant operations perspective,” Duclaux says. “The key is making better use of KPIs through tighter unification of business and manufacturing operations.”

Adds Alison Smith, VP of market research and strategy at AspenTech, “By putting plant operations into a business context using manufacturing intelligence software, you’re able to empower plant operators through real-time decision support, which helps drive enterprise agility from the top down and bottom up.”

Improved product quality is a byproduct of real-time manufacturing intelligence, but manufacturers increasingly are trying to embed quality into products at the design stage, and that requires adherence to the next 2010 trend…

More social product development

Product lifecycle management software vendor PTC has been credited with pioneering the social product development movement when it released Windchill ProductPoint, an application that uses the SharePoint collaboration engine from Microsoft to allow product development teams to share data created in CAD systems. But other vendors have taken this concept further, linking product designers from across the globe to collaborate on the development of new, innovative products.

Some vendors call this “social product development,” while others call it “open innovation” or “crowdsourcing.” Mark Turrell, CEO of Imaginatik, says such approaches will gather steam as more companies realize that innovation involves more than doing research in labs or engineering departments. “Growth often comes from innovation in new channels, new packaging, business models and so on—and it makes no sense to treat innovation as a single- function business activity, hidden away with scientists in R&D.”

Turrell says it may require a cultural change for some companies to embrace the idea of looking outside for innovative ideas, “but they really don’t have a choice anymore. The pace of change is too rapid—and no firm can hire all the best people.”

Sustainability, SaaS and wireless technology

Lastly, we can’t talk trends without mentioning three big ones for 2009 that promise to continue into 2010. Look for manufacturers to make environmental awareness an integral part of all business processes—from product design to component and material selection, production processes, and even the operation of factories and production equipment. The Software-as-a-Service (SaaS) model is expected to continue gaining popularity as companies look to lower the cost of adopting the new solutions they need to support improved business processes. The wireless revolution will continue as well, with manufacturers adopting more wireless solutions in production settings as an alternative to more expensive wired networks.