Interact Analysis reports global output projected to grow 2% in 2025, led by China and the U.S., while Europe contracts.

New research by market intelligence firm Interact Analysis reported that manufacturing growth has been flat, with minimal change since Q1. The findings are part of the company’s latest update to the Interact Analysis Manufacturing Industry Output Tracker (MIO Tracker). Low growth and limited investment are likely linked to uncertainty over rapidly changing U.S. trade policies. Some analysts had predicted that new tariffs could trigger a recession, but this has not occurred to date. In 2025, global manufacturing output projected to grow 2%, with most growth in China and the United States, while Europe is expected to see a modest decline.

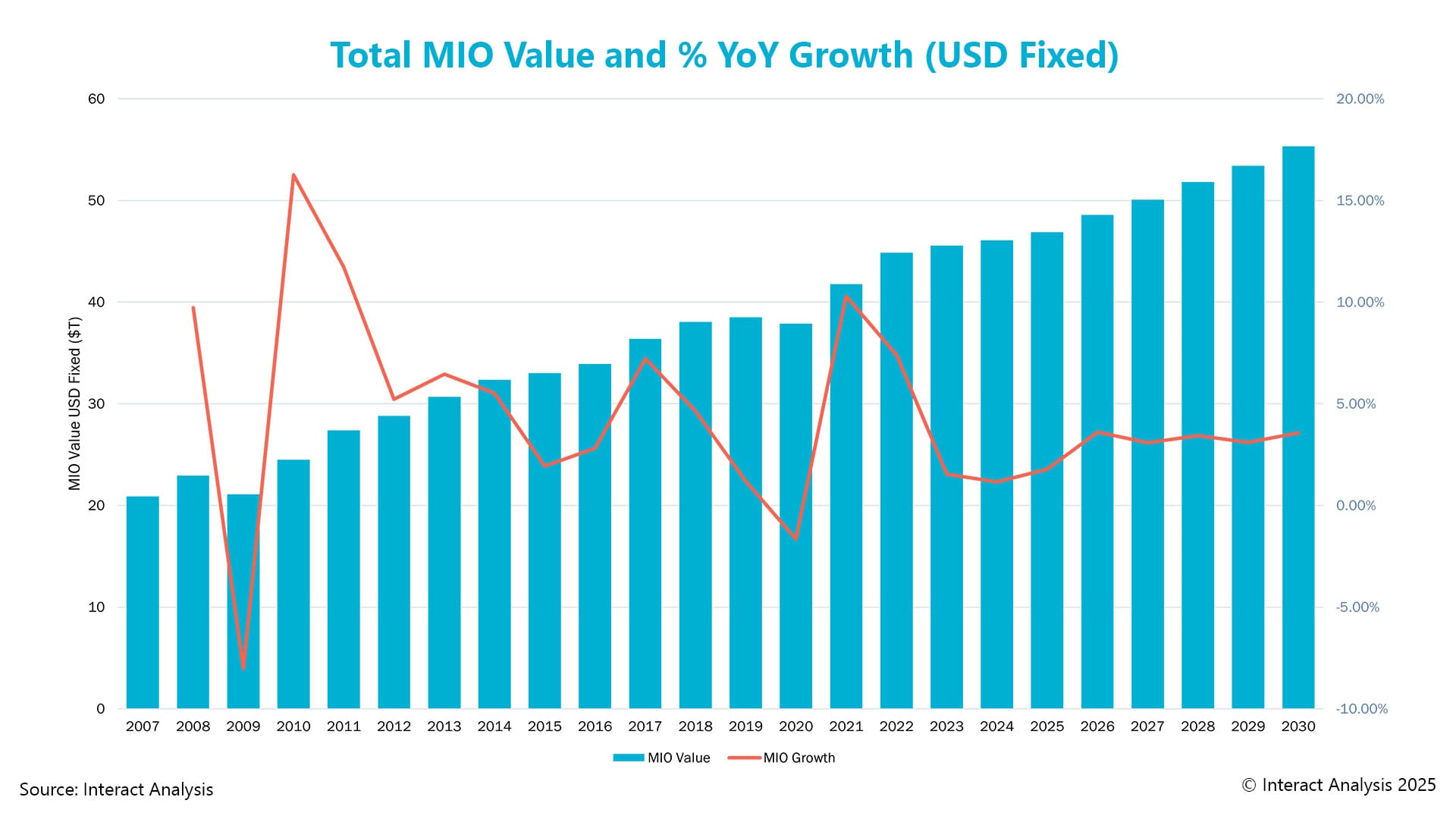

Understanding current, past, and projected market conditions is important in a complex sector. This report measures the total value of manufacturing production across more than 102 industries and 45 countries, including 18 years of historical data covering a full business cycle from before the recession to the present. The country data is organized around a common taxonomy to support consistent comparisons, and the report includes five-year forecasts.

Major manufacturing regions show varied growth prospects

After modest growth early in the year, the overall manufacturing sector has slowed due to U.S. tariff policies. While tariffs have influenced global manufacturing growth, the three major economic regions haves performed differently. In Europe, major industrial economies – Germany, France, the UK and Italy – are stagnant. Smaller European manufacturing economies, including Poland, Spain and the Czech Republic, are growing and expected to gain market share through the early 2030s.

Larger economies and key semiconductor hubs in the APAC regions are expected to see steady growth, supported by AI-driven investment and broader geopolitical strategies.

In the Americas, manufacturing depends on the current state of the U.S. economy, which remains uncertain. Nearshoring investments are increasing and may support manufacturing growth.

Destocking and US tariffs impact the global machinery sector

Two factors are currently affecting the global machinery sector: higher interest rates, which reduced production and created excess inventory, and the resulting destocking process that has slowed output. As destocking winds down, recent interest rate declines could help the sector recover more quickly.

A recent factor affecting the machinery sector is the introduction of tariffs by U.S. President Donald Trump, which have slowed signs of recovery. Planned capital expenditure has been delayed due to tariff uncertainty. Machinery orders increased temporarily as buyers moved ahead of tariff deadlines, but orders are expected to decline that after implementation, leading to reduced production.

Commenting on the latest results, Jack Loughney, lead analyst for the MIO Tracker at Interact Analysis, said: “The economic uncertainty caused by tariffs has put a dampener on what could’ve been a good year for the global manufacturing. Despite this, we still expect 2.1% growth in 2025.”

Edited by Puja Mitra, WTWH Media, for Control Engineering, from an Interact Analysis news release.