The Bundy Group reported 15 automation transactions in the month of March. Analysis on the acquisitions and reports are highlighted below.

Bundy Group, an investment bank and advisory firm, provides an update on mergers & acquisitions and capital placement activity in the automation market.

Highlights in recent system integrator acquisition

Bundy Group recently represented Bob Zeigenfuse in a sale of Avanceon to Vinci Energies. Founded in 1984, Avanceon is an automation solutions and systems integration firm that works with clients across a variety of end-markets, including infrastructure, food & beverage, pharma, data centers and chemicals. Zeigenfuse was a long-time relationship of Bundy Group’s, and he retained our firm to market the business to a pool of quality buyers that have a seasoned acquisition track record in the automation sector. Vinci Energies submitted a preemptive offer worthy of our client pausing marketing efforts and moving forward with this strategic buyer.

Zeigenfuse offered insights related to the sale of Avanceon highlighted below.

Bundy Group: As your investment banking advisor, I know that you had a lot of buyer options to consider. Why did you select VINCI Energies as the buyer for your firm?

Bob Zeigenfuse: There are certainly a lot of great buyer options out there! My foremost consideration was my beloved associates at Avanceon. The key criteria I had for my associates in a transaction included:

-

Cultural fit: I needed to envision my executives and associates enjoying and thriving under a new owner’s structure. I really liked Vinci’s management style, which focuses on operations running autonomously and retaining Avanceon’s culture. Through the Control System Integrators Association (CSIA), I had seen plenty of examples of roll-up strategies that had struggled and failed because the buyers didn’t commit to these fundamentals.

-

Stability: Vinci Energies is a $50 billion international corporation, with a strong financial backbone, which will allow our team to continue to grow the Avanceon platform.

-

Opportunities: Vinci Energies offers my team members new career growth opportunities, stock option plans, and access to an international network of employees and clients.

My needs were straightforward:

-

Receiving an attractive valuation and deal structure.

-

Selecting a strategic buyer platform focused on building an organization to last forever. I wasn’t interested in a short-, medium- or long-term flipper.

-

Working with a buyer that was transparent, professional, and compassionate from beginning to end.

At the conclusion of the transaction, I can say with confidence that Vinci Energies fulfilled all of my above expectations.

Bundy Group: What advice would you give owners in the Automation market as they contemplate how to build value in their business?

Bob Zeigenfuse: Build value that buyers want! There are several key components that make up this business value:

- Focus on repeatable financial performance with solid clients in desirable markets. If you build repeat business with strong Accounts Receivable collections, then it proves to a buyer that your company is well run.

- Achieve a 10%+ Adjusted EBITDA. For determining the most accurate Adjusted EBITDA, you need to track extraordinary and one-time expenses so you can prove those critical financial details to a buyer.

- If you want to receive a strong valuation, then plan for leaving a normal level of working capital in the business at a transaction close. The buyer will expect there to be enough balance sheet proceeds (i.e. Accounts Receivable + Inventory – Accounts Payable) left in the business to help fund operations immediately after a transaction close.

- Don’t get innovative/creative with accounting. Follow GAP accounting guidelines or suffer corrections… and less deal dollars… after buyer due diligence.

- If an owner wants to fully retire, then building a seasoned management team with a proven operations track record is critical. However, this can be a double edge sword, as there is increased risk to an owner not involved in the day to day. In short, that owner doesn’t have as much control over the business and management, including during the sale process. In hindsight, I would have remained more involved in the business and phased myself out over a three-year period after transaction close. This would have created less risk for me in a sale process.

Bundy Group: I’m a believer in the advisory, or deal, team that is there to support an owner in the run up to, and then through, a sale process. Who was critical to you from an advisory standpoint and why?

Zeigenfuse: There are several key players for an owner to have in his corner in a transaction:

-

Investment banker – From keeping informed about the state of the automation M&A market, I knew that it was cycling high. An investment banking advisor experienced in the automation sector greatly increases the chance of realizing those robust valuation goals.

-

Legal advisor – I learned through a prior transaction what happens if you hire an inexperienced lawyer more focused on wasting time and not closing a transaction. An experienced, deal making lawyer is key, as it will make the process go much smoother while also protecting the seller’s interests. In addition, the buyer (and my wallet) appreciated the fact that I hired an experienced legal team.

-

Transaction accounting team – I was advised to hire an outside transaction accounting team to complete a quality of earnings report (“QofE”). This thorough analysis, managed by an experienced, independent third accounting party, validated the financial strength of Avanceon and gave me the leverage to negotiate terms around my desired transaction goals. In addition, the buyer and its transaction accounting team had an easier path to complete due diligence, especially since they found no major issues with my Company’s QofE. Finally, it was great to have a transaction accounting team in my corner during due diligence.

March 2023 automation transactions

3/17/23

Summit Park announced the sale of its portfolio company, Tennessee Industrial Electronics (“TIE” or the “Company”), to Diploma, PLC. Headquartered in LaVergne, Tenn., TIE is a leading provider of refurbished parts and repair services, specializing in computer numerical control (“CNC”) systems and robotics. Learn more.

3/16/23

CAST AI, the intelligent cloud-native automation and cost management startup, announced the closing of a $20M investment round led by Creandum, an early-stage venture capital investment firm behind companies like Spotify, neo4j, and Klarna. Learn more.

3/16/23

Nimble, an autonomous logistics and AI robotics company, has raised $65 million in a Series B financing round led by Cedar Pine, with participation from existing investors DNS Capital, GSR Ventures, and Breyer Capital, among others. Learn more.

3/15/23

Clarapath, a New York-based medical robotics company, acquired Crosscope, a Mountain View, CA-based digital pathology company. The acquisition combines Clarapath’s SectionStar, an automated, all-in-one tissue sectioning and transfer system with Crosscope’s workflow and computational pathology tools enabling labs to deliver faster, cost effectively, and at higher quality. Learn more.

3/15/23

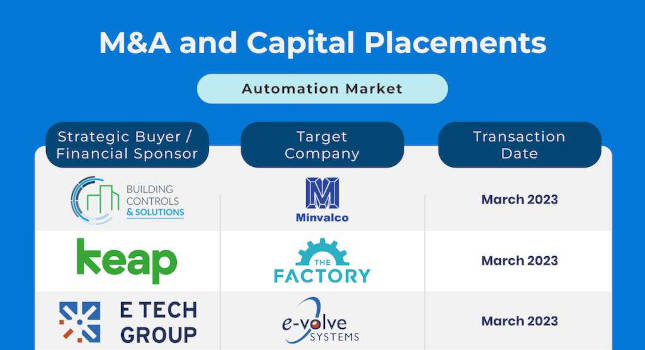

Keap, the leader in sales and marketing automation software for small businesses, has acquired The Factory. A former Keap partner, The Factory assists small business owners with building powerful marketing strategies and implementing sales and marketing automation. Learn more.

3/15/23

GSG GENII Software Group (“GENII”) has completed the acquisition of iVention. iVention provides laboratories in a wide range of industries with its powerful and flexible iVention Lab Execution System (iLES), a software system designed specifically for and around the laboratory process. Learn more.

3/13/23

Simpli.fi, the advertising automation platform for agencies, brands, and media companies, confirmed that it has completed the previously announced acquisition of Bidtellect, a leading contextual and native demand-side platform (DSP). Learn more.

3/6/23

ScalePad, which provides asset lifecycle management automation and is backed by Integrity Growth Partners, has acquired ControlMap, a best-in-class Governance, Risk, and Compliance (GRC) platform for MSPs. Learn more.

3/2/23

E Tech Group, owned by Falfurrias Capital Partners, acquired E-Volve Systems, a leading provider of industrial automation, controls engineering and computer systems validation to clients in the life sciences, food and beverage, and consumer products industries. Learn more.

3/1/23

Rockwell Automation, Inc. (NYSE: ROK), the world’s largest company dedicated to industrial automation and digital transformation, has acquired Knowledge Lens. Knowledge Lens will join Rockwell’s premier digital services business, Kalypso, to accelerate transformational outcomes for more manufacturers around the world. Learn more.

3/1/23

Building Controls & Solutions (“BCS”) is joining forces with Minvalco, a leading provider of building automation systems and components based in Minneapolis, MN. This acquisition continues the execution of BCS’s strategy to grow its leading position in the North American building automation market. Learn more.

2/28/23

CORE Industrial Partners, a manufacturing, industrial technology, and industrial services-focused private equity firm, acquired D&R Machine Company, a provider of CNC precision machining solutions for the aerospace & defense market, by CORE portfolio company Cadrex Manufacturing Solutions. Learn more.

2/23/23

Rockwell Automation, Inc., the world’s largest company dedicated to industrial automation and digital transformation, announced a strategic investment in READY Robotics, a pioneering company in software-defined automation and a Rockwell Technology Partner. Learn more.

2/23/23

Keysight Technologies Inc. is expanding its electronic design automation (EDA) solutions portfolio by acquiring Cliosoft. Keysight will add Cliosoft’s line of hardware design data and intellectual property (IP) management software tools to its EDA solutions lineup. Learn more.

1/10/23

APCT, a designer and custom manufacturer of advanced technology printed circuit boards, has entered into a definitive agreement to acquire and merge with Advanced Circuits, Inc. and its affiliated entities and subsidiaries (collectively, “Advanced Circuits” or “ACI”). Learn more.

Bundy Group is a CFE Media and Technology content partner. Edited by Chris Vavra, web content manager, Control Engineering, CFE Media and Technology, [email protected].

ONLINE extra

Bundy Group is a boutique investment bank that specializes in representing controls and automation, Internet of Things, and cybersecurity companies in business sales, capital raises, and acquisitions. Over the past 33 years, Bundy Group has advised and closed on over 250 transactions, which includes numerous automation-related transactions. You can learn more at www.bundygroup.com or by contacting Clint Bundy.