Most software applications are model-based, and include the set of procedures required to, for example, build a schedule, design a product, or control a production process. Search is different. It's an interface. And yet search is more than a box in the upper right corner of a screen. Combined with a data model and appropriate infrastructure, search is the means to very powerful applications.

Most software applications are model-based, and include the set of procedures required to, for example, build a schedule, design a product, or control a production process.

Search is different. It’s an interface. And yet search is more than a box in the upper right corner of a screen. Combined with a data model and appropriate infrastructure, search is the means to very powerful applications.

Today’s largest aerospace, automotive, and high-tech companies have become global megacorporations. To achieve economies of scale expected from such large organizations, product information must be served up adroitly to growing numbers of knowledge professionals playing many specialized roles.

Significant advances are being made today in applying search technology to manage product-related data within large corporations.

“We routinely share 3D content across various enterprise functions using Deep Server Web as a communications enabler for value-added derivatives and vendor information as well as source CAD data,” says Steve Lewis, manager of simulation at Bell Helicopter , Ft. Worth, Texas. “We believe Deep Access will add further value by enabling us to stream live updates into our integrated communications flow.”

As detailed in the sidebar, Search served up in a document management environment , the developer of Deep Access, a system for digital media asset management, is a company called Right Hemisphere , which will soon release a technology that may yet further advance how deeply buried product information is brought to light.

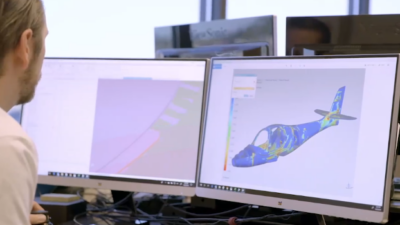

A brief Internet-based demonstration of the emerging capability involved manipulation of an extremely light-weight 3D model representation of an aircraft. The model combined CAD technologies with others common to the gaming industry to allow its rapid manipulation. The user visually homes in on the relevant assembly, subassembly, or component and is thereby served up menus offering access to customized configurations; associated product manufacturing information (PMI); 2D and 3D design data; and historical documents.

“This is an emerging paradigm for presenting complex data in an easy-to-access way,” says Rix Kramlich, a Right Hemisphere company VP. “Rather than search by parameters accompanied by visuals, this is the future—an interactive and highly intuitive visual means to browse complex products. It’s revolutionary in that anyone with a Web browser can access impossible-to-find data in the context of their business process.”

Another company, Endeca , is forging new product information-related solutions using search.

“As companies evolve and mature social networking and collaboration,” says Joe Barkai, a senior analyst with Framingham, Mass.-based IDC Manufacturing Insights , “they will amass large amounts of structured and unstructured product data pertaining to products, suppliers, and customers. Searching in this corpus of knowledge will be the next challenge of PLM [product life-cycle management] 2.0 tools.”

It’s a product thing

Getting a better handle on product data is a pressing issue. If an engineer for an industrial goods maker has to ask someone if a particularly exotic product configuration was built before, that’s a problem. The engineer may not know who to ask, or that person may already be retired.

CAD and PLM do a great job of managing engineering data, but relevant product information resides across systems, often including bills of material found in the enterprise system. Marketing and technical professionals need CAD-related data, but finding it is tied to “the PLM system’s file format and the engineering development process.” Worse, the engineers “hate being interrupted.”

| Guided summarization of search results makes it possible to not only return relevance-ranked results, but also graphs, charts, maps, and other visual summaries of the subject data set. |

Moreover, it’s the rare global corporation, or even divisional unit, that has only a single brand of CAD. Some therefore use enterprise integration and data warehouses for enterprise product data management. Others say this is an expensive proposition best avoided.

Steve Papa, CEO of privately held Endeca, says in 2007 company revenues were $108 million, with about 25 percent coming from manufacturing industries. Papa says he’s in the business of making product information visible.

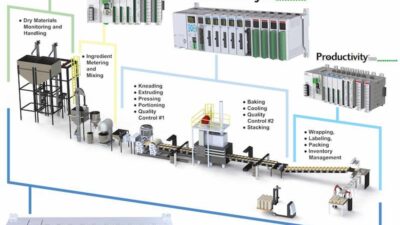

Endeca uses a kind of search and guided navigation to allow engineers and procurement, supply chain, and other knowledge professionals to make sense of “all” data about a product life cycle—from technical attributes to supplier preferences and ratings, warranty information, HAZMAT compliance data, and inventories.

This, says Papa, contrasts with traditional enterprise search, “which only creates a simple information list,” and with business intelligence (BI) tools that require power users to understand relational database (RDB) schemas and also ignore less structured, non-relational data.

The challenge for Endeca, says Papa, is that professionals in product development, sourcing, and supply chain tend to think in terms of either structured or unstructured data.

“If structured, it’s a business intelligence function; if unstructured, it’s about enterprise search,” says Papa. “Stakeholders have trouble getting their arms around a system that fuses search and BI, changing the constraints. It’s precisely that change that creates new value.”

| Product-centric search technologies applied to enterprise systems using Right Hemisphere Deep Access brings to light things like custom configurations, product manufacturing information, 2D and 3D design information, and historical documents. |

Endeca represents an advance in search capabilities, “with a different approach to an old—and poorly addressed—problem,” claims Papa. “We take advantage of ‘price discontinuities’ for memory-based processing that make it much more widely available than it was even a few years ago.”

In the past, Papa says, limits to computing power required enterprise search to “destroy” rich parts and supplier information in database schemas, reducing the information to simple unstructured document records in a search index.

“Taking advantage of widely available memory-based processing,” says Papa, “means search can preserve rich relationships within a single database—and spanning across databases and file shares—thus incorporating the systems galaxy of structured and unstructured data in an easy-to-use interface.”

The power and speed of memory-based processing means a search also categorizes and contextualizes results, and sets up the user for further detailed inquiry, says Papa. “Given the data’s complexity, a list of results doesn’t cut it. People want to interact with the data in an easy-to-use interface.”

Melbourne, Fla.-based Harris Corp. is a $5-billon communications and IT provider with nearly 16,000 employees, including 7,000 engineers and scientists. Over a four-year period, Harris had invested in enterprise and supply chain systems to optimize operations.

The company says the investments created a wealth of information, but it was difficult to gain holistic, contextual views to inform decision-making.

| Using Endeca’s Information Access Platform (IAP) to span multiple enterprise systems, companies can explore and select options that meet overall supply chain objectives. Rather than simply return search results, the system categorizes and contextualizes the information for further detailed inquiry. |

Today, Harris uses Endeca’s Information Access Platform (IAP) to span multiple divisions and unite information from systems that include Oracle Agile product lifecycle management; PartMiner component information, Dun & Bradstreet business information, and key supplier systems—as well as several custom applications—creating a massive index of more than 70 million records.

Using the capability, Harris professionals can explore and make decisions related to supply chain objectives. The company says it reduced design and production costs through better supplier selection and parts reuse, avoidance of risk, higher quality, and accelerated time-to-market.

Beating on the RDB

The enterprise workhorse for transaction processing is therelational database, says Papa, but “for effective information access, you must be able to predetermine what the data will look like and how it will be accessed long before the system is operational.”

It’s near impossible to do so in the dynamic environment of the manufacturing enterprise. In fact, notes Papa, the very notion of schema and easy-to-use improvisational search are mutually exclusive.

For example, say RoHS or some other regulatory regime is suddenly a priority. With relational or other rigid data schemas, performance-acceptable access or search along relevant parameters requires devising new schema.

Instead, Endeca employs a class of database appropriate for summarizing and uniting heterogeneous enterprise data. Users explore a single repository or a map of a single connection across multiple disparate repositories—e.g., part number, supplier number, or RoHS characteristic—as a seamless experience.

“You take advantage of relationships in your schemas and file shares,” says Papa, “and, if RoHS becomes an issue, you just map a connection to the new data, not a new schema. To make this work, Endeca objects and relationships summarize results in ways easy to understand.”

Guided summation and categorization make it possible to not only return relevance-ranked results but also graphs, charts, maps, and other visual summaries of the data set that then re-compute based on user interaction with data parameters.

The data store actually can occupy less space than the source relational schemas. “For example,” says Papa, “in one customer situation, a total of 2.5 terabytes of data in several relational databases—used to track millions of unique product configurations through production—was reduced to less than 100 gigabytes in the Endeca system.”

A typical investment in Endeca’s solutions serves hundreds to thousands of users and ranges from $250,000 to $1,500,000.

The enterprise angle

Right Hemisphere and Endeca are similar in that both are about business process-centric search.

What Right Hemisphere has, says Kramlich, is what any successful enterprise system vendor has: a data model and robust architecture based on server-side tools.

“Things get interesting,” he says, “when you leverage that with applications to manage business processes.”

Endeca too has a data model and architecture, and it too hooks into data repositories to search for information that supports a business process.

“Where we’re different is the nature of the data and the business processes involved,” says Kramlich. “It’s two different animals, yet two complementary approaches from two leaders in business process-context search.”

For Right Hemisphere, the objective is to unlock data hidden in proprietary document/CAD formats; make data portable both as text information for downstream use and interactive 3D visuals; and use the resulting framework for looking up information found in enterprise systems.

For Endeca, the point is to stitch together information from disparate systems—or even a single database—to ease information access and bring to the surface nonobvious relationships to enable decision support.

While Right Hemisphere’s applications are aimed primarily at downstream product data uses, and Endeca’s are mainly supply chain and engineering-related, the solutions also could be seen as application development platforms waiting to be extended even more widely.

Search served up in a document management environment

Right Hemisphere says five of the top six automotive OEMs and nine of the top 10 U.S. aerospace & defense contractors use its solutions today.

It also says Right Hemisphere Deep Access, introduced in February, is about more than search. It is a unified, searchable repository of 2D, 3D, and related media assets and metadata.

“The key to Deep Access,” says Rix Kramlich, a company VP, “is it allows anyone to find product data that may reside across multiple systems—including multiple CAD and PLM [product life-cycle management] systems—and present it to stakeholders in a way that can be tuned to the needs of the consumer.”

These derivatives include requests-for-proposal, technical documents such as operating manuals, or instructions for use in the production environment.

“You have PLM on the one hand, and on the other document management systems,” says Mark Thomas, Right Hemisphere president and CTO. “We see a gap in the middle and virtue in a system that’s cognizant of the complexities of product data, but looks like a document management system. It’s not just managing raw CAD data, but the workflows, production, and management of derivatives. 3D is now a part of everyday life—for parts catalogs and operating manuals, for example—and can no longer be ignored outside of engineering.”

Thomas says knowledge professionals engaged in producing derivatives can spend 75 percent of their time just finding the right stuff to work on.

Right Hemisphere solves the problem using several varieties of search:

Basic keyword search;

Parametric-based search—e.g., the parameters that define a part or assembly, or that are relevant to the business environment;

Project-based search—i.e., a “tree” structure for file browsing; and

Visual search, which will grow in importance.

As a publishing engine, Deep Access has applications as follows:

Create graphic derivatives automatically with varying levels of detail for 3D models, 2D vector illustrations, and publishing to PDF;

Media authoring tools for training content, illustrations, parts catalogs, and other “derivatives”;

Translate CAD data into lightweight 3D models for Web use; and

Automate graphics optimization.

The other main function of Deep Access is as a workflow and collaboration engine, both inside the firewall—with version management and markup tools—and outside, using extensions to Adobe 3D, Acrobat Professional, and Reader.

Deep Access is a module that connects to Deep Server and the RH5 Platform, and is available today at per-seat pricing of $995 for a server-connected user.