The July issue of Manufacturing Business Technology is devoted in its entirety to covering the 2007 Global 100 listing of leading information technology (IT) and software providers in manufacturing and supply chain. Why is it important to know what these companies are up to, and how these markets are changing? It's because the work they do, both individually and collectively, is important.

The July issue of Manufacturing Business Technology is devoted in its entirety to covering the 2007 Global 100 listing of leading information technology (IT) and software providers in manufacturing and supply chain.

Why is it important to know what these companies are up to, and how these markets are changing?

It’s because the work they do, both individually and collectively, is important.

A United Nations Population Fund report released in June of this year says that by 2008 more than half the world’s population, 3.3 billion people, will for the first time live in towns and cities, and the number is expected to swell to a mind-boggling five billion by 2030.

Continuing technology advances will be central to any attempt to reach levels of industrial production sufficient to supply growing third-world populations with affordable basic goods. To not make the attempt is an open invitation to violence, war, and pestilence.

We’re looking then to a future in which global manufacturing systems will be of unimaginable complexity. Enterprise, product, customer, and plant systems will be the collaborative, integrated means for dealing with this complexity.

Exactly how needed rigor in supply chain integration across disparate legal entities will be achieved, or how remaining collaboration barriers within manufacturing enterprises will be overcome, may still be unclear.

But the competition around these issues within manufacturing enterprise IT markets is being as fiercely fought as are the battles of MySpace versus Facebook and Microsoft versus Google. This is the stage upon which decisions will be made and solutions worked out. And there is real money involved.

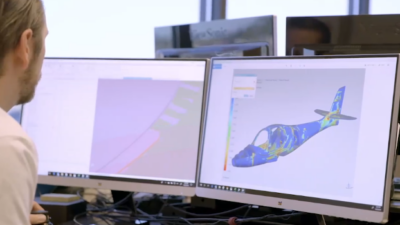

An exemplary example is afforded by two companies discussed elsewhere in the issue: $115-billion automation giant Siemens and the vendor of product design technology it recently spent $3.5 billion to acquire: UGS PLM Software.

As was made clear at the recent UGS analyst and media event held at the Waldorf Astoria in New York City, Siemens acquired UGS because it believes closer integration—in fact a kind of merging—between design engineering and plant operations will deliver great value to manufacturers—immediately, but most especially in coming years.

But in making the attempt, Siemens brings itself into closer competition with major enterprise system vendors Oracle and SAP, which both seem to believe product lifecycle management (PLM) should be integral to ERP.

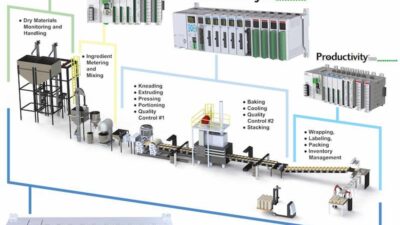

It also ups the ante in Siemens’ more traditional competition with other automation vendors—including Rockwell Automation, Wonderware, and Invensys—to define the software infrastructure for the plant-floor execution space.

It’s the goods makers that will ultimately decide, but the management concepts, technology infrastructures, user cases examples, and product technologies put forth by the Global 100 vendors go a long way in defining the issues involved.

Look for continuing detailed coverage of Siemens’ evolution, and that of all the Global 100, in this and upcoming issues of the magazine. It’s a horse race, but a horse race that matters.