The Bundy Group reported 18 automation transactions in its July 2025 summary reports. Analysis on the acquisitions and reports are highlighted below including transactions involving robotics, AI, HMI, flow control, motion control, motors, drives, sensors and others.

July 2025 merger, acquisition, automation industry insights

- In the July 2025 monthly report to Control Engineering website, the Bundy Group, which helps with mergers, acquisitions and raising capital, reported 18 transactions.

- Companies included in the Bundy Group July 2025 reports include Graybar, Roxia Automation, Siemens, Voliro, among others.

- Technologies involved include industrial aerial robotics, artificial intelligence, human-machine interface, flow control, instrumentation, motion control, motors and drives and sensors, among others.

Bundy Group, an investment bank and advisory firm that specializes in the automation segment, provides an update on mergers and acquisitions and capital placement activity for this industry, with 18 July 2025 report transactions, involving Graybar, Roxia Automation, Siemens, Voliro among other companies. Technologies involved include industrial aerial robotics, artificial intelligence (AI), human-machine interface (HMI), flow control, instrumentation, motion control, motors and drives and sensors and others.

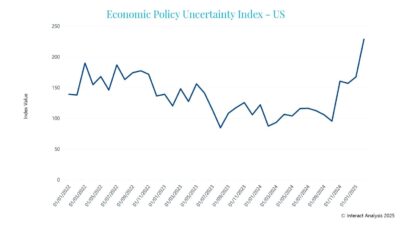

The Bundy Group said that the automation market continues to experience many mergers and acquisitions (M&A) and capital markets activities. Drivers of this activity include the growth-oriented nature of the automation market, the consolidation opportunities within the industry and the strength of many of the companies operating within it. The automation market has attracted a critical mass of strategic buyers and financial sponsors (private-equity groups, family offices, institutional investors) that seek to own or invest in the industry. From such Bundy Group closed automation transactions as CITI System Integrators and Ultimation, and the team continues to see strong interest from a range of qualified buyers in the automation segment. Further evidence of the robust M&A and capital placement activity in automation is provided in the transactions listed.

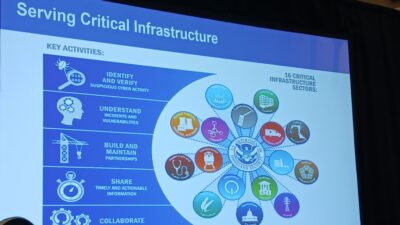

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence and cybersecurity. This serves as a leading indicator for submarkets the Bundy Group follows. For Control Engineering, Bundy noted the following automation, controls and instrumentation transactions.

Cognosos acquired Cox 2M, July 9

Cognosos acquired Cox2M, the IoT business unit of Cox Communications, to strengthen its position in AI-powered asset tracking and location intelligence. Cox2M brings expertise in real-time tracking, connected operations and IoT sensors across logistics, automotive and industrial sectors. The acquisition expands Cognosos’ customer base and accelerates its growth in industrial IoT and smart operations.

HECO acquires Fife-Pearce Electric Co., July 7

HECO acquired Fife-Pearce Electric Co., a Detroit-based electric motor service and repair provider, in a strategic move to expand its industrial service capabilities in the Metro Detroit area. Fife-Pearce, founded in 1923, brings a long-standing reputation for AC/DC motor rebuilds, rewinding, controls and industrial drive system services, supporting customers across manufacturing, utilities and automation-heavy industries. The transaction strengthens HECO’s presence in plant maintenance and reliability services, reinforcing its role in industrial automation and plant engineering operations.

HKW acquired Electric Equipment & Engineering, July 3

HKW, a middle market private equity firm focused on growth companies, acquired Electric Equipment & Engineering Co. (EEE), a manufacturer of highly engineered electrical power products serving the power, telecommunications and broadband industries. HKW’s strategic resources and industry expertise are expected to support EEE’s next phase of growth, continuing HKW’s focus on manufacturers of engineered products.

Siemens acquired Dotmatics, July 1

Siemens AG has completed the acquisition of Dotmatics, a Boston-based Life Sciences R\&D software provider and portfolio company of Insight Partners, for $5.1 billion. Dotmatics will join Siemens’ Digital Industries Software business, expanding its PLM portfolio into the Life Sciences market. The acquisition enhances Siemens’ AI-powered product lifecycle management (PLM) capabilities and supports growth in multi-modal drug development through Dotmatics’ Scientific Intelligence Platform, Luma.

Siemens acquired ebm-papst’s Industrial Drive Technology, July 1

Siemens has finalized its acquisition of ebm-papst’s Industrial Drive Technology (IDT) division, adding around 650 employees in Germany and Romania. The IDT portfolio, which includes intelligent mechatronic and drive systems for autonomous industrial transport solutions, will enhance Siemens’ Xcelerator portfolio. This move strengthens Siemens’ leadership in flexible manufacturing automation by expanding its offerings in battery-powered drive and robotic systems and unlocking new market opportunities through its global sales network.

Valin Corp. acquired Burns Controls, July 1

Valin Corp. acquired Burns Controls Co., based in Dallas, Texas, effective June 30, 2025. The acquisition enhances Valin’s motion control and automation product portfolio. Founded in 1971, Burns Controls provides electrical, hydraulic and pneumatic products worldwide. Valin, a Graybar subsidiary, serves the technology, energy, life sciences, natural resources and transportation industries with technical solutions and engineering services.

Caverion acquired Roxia Automation, July 1

Caverion Suomi Oy acquired Roxia Automation Oy (formerly Polar-Automaatio), boosting its industrial automation services in Finland. With €7 million in 2024 sales and 47 employees, Polar-Automaatio will continue as a Caverion subsidiary, providing full lifecycle automation services to clients in metal, mining, energy, chemical, paper and marine sectors.

Southworth International Group acquired Gruse Maschinenbau, June 27

Southworth International Group Inc. (SIGI), a global provider of ergonomic material handling solutions, acquired Gruse Maschinenbau GmbH & Co. KG, a 156-year-old German engineering firm specializing in customized lifting systems. Headquartered in Aerzen, Germany, Gruse serves customers in 55 countries. The acquisition strengthens SIGI’s presence in Germany and Europe, expanding local engineering capabilities and production capacity.

DNOW plans to acquire MRC Global, June 26

DNOW Inc. plans to acquire MRC Global in an all-stock transaction valued at approximately $1.5 billion, creating a leading energy and industrial solutions provider. The combined company will have over 350 service and distribution locations across more than 20 countries, offering expanded capabilities to energy, gas utility and industrial customers. MRC Global shareholders will receive 0.9489 shares of DNOW for each MRC share, representing an 8.5% premium.

Parker Hannifin Corp. plans to acquire Curtis Instruments, June 30

Parker Hannifin Corp. plans to acquire Curtis Instruments Inc. from Rehlko for approximately $1 billion in cash. Curtis designs motor speed controllers, instrumentation, power conversion and input devices that complement Parker’s electric vehicle motors and electrification technologies. The transaction is subject to regulatory approvals and is expected to close by the end of 2025.

Stellex Capital Management buys part of Dürr Group, June 30

Dürr AG agreed to sell its environmental technology business, including exhaust air purification and sound insulation systems, to an affiliate of Stellex Capital Management. This sale completes Dürr’s plan to simplify its group structure and focus on production automation. Dürr will retain a 25% reinvestment in environmental technology. The business has an enterprise value of approximately €385 million, with expected net proceeds of around €250 million to reduce debt.

Bridgepoint plans to buy NMi Group, June 10

Levine Leichtman Capital Partners agreed to sell its portfolio company NMi Group to Bridgepoint, pending customary regulatory approvals. Headquartered in Delft, the Netherlands, NMi is a leading provider of testing, inspection and certification services for complex and mission-critical technologies. Under LLCP’s ownership, NMi achieved significant growth, completing eight strategic acquisitions, expanding its geographic reach and increasing its workforce from 80 to over 300 employees.

IFS acquired TheLoops, June 26

IFS has acquired TheLoops, a provider of autonomous AI agent technology, becoming the first vendor to offer an industrial-grade AI agentic platform built for mission-critical assets and processes. This acquisition marks a transition from enterprise software that tracks work to software that performs it—delivering measurable ROI, productivity and resilience while ensuring security and governance from the start.

Nordic Semiconductor acquired Memfault, June 24

Nordic Semiconductor acquired its long-term partner Memfault Inc., a cloud platform provider for large-scale connected product deployments, marking a strategic shift from hardware supplier to full solution partner. By integrating hardware, software and cloud services into a unified platform, Nordic now offers a streamlined path for development, deployment and lifecycle management of connected products—enhancing security, performance and functionality while reducing complexity for customers.

Score acquired Callidus, June 19

Callidus, a global provider of flow control, valve management, and welding solutions for the mineral processing and LNG sectors, has been acquired as part of the Score Group’s growth strategy. This marks Score’s third strategic acquisition in recent weeks, following BLJ In-Situ Solutions and Drake Controls, and expands company presence across APAC while enhancing capabilities in Indonesia, Papua New Guinea, Madagascar and New Caledonia.

TDK Corp. acquired SoftEye, June 19

TDK Corp. acquired SoftEye, a U.S.-based systems solution company developing custom chips, cameras, software and algorithms for use in smart glasses. The acquisition strengthens TDK’s position in the AI ecosystem by adding advanced eye-tracking and object recognition technology. SoftEye’s hardware and software enable low-power, always-on systems designed to enhance AR/VR display solutions and create a new human-machine interface for AI interaction through eye movement.

Cherry Ventures invested in Voliro, June 16

Voliro, a Swiss pioneer in aerial robotics, announced an extension of its Series A round, bringing the total raised to $23 million. Voliro’s Series A extension saw new participation from noa (a venture capital firm) and the addition of a debt facility from UBS. The original round was led by Cherry Ventures. This additional capital will accelerate the development and global deployment of Voliro’s autonomous aerial inspection robots—designed to modernize infrastructure maintenance, enhance industrial safety and address growing workforce shortages.

Crane Co. acquired Precision Sensors & Instrumentation, June 9

Crane Co., an industrial manufacturing and technology firm, acquired Precision Sensors & Instrumentation, a provider of sensor-based technologies for the aerospace, nuclear and process industries, from Baker Hughes. The acquisition strengthens Crane’s portfolio with complementary brands and is expected to enhance its presence across key industrial end markets.

Clint Bundy is managing director, Bundy Group, which helps with mergers, acquisitions and raising capital. Edited by Mark T. Hoske, editor-in-chief, Control Engineering, WTWH Media, [email protected].

Online

Search on Bundy at www.controleng.com for more merger and acquisition news.

Control Engineering provides more information about automation and industries applying automation.