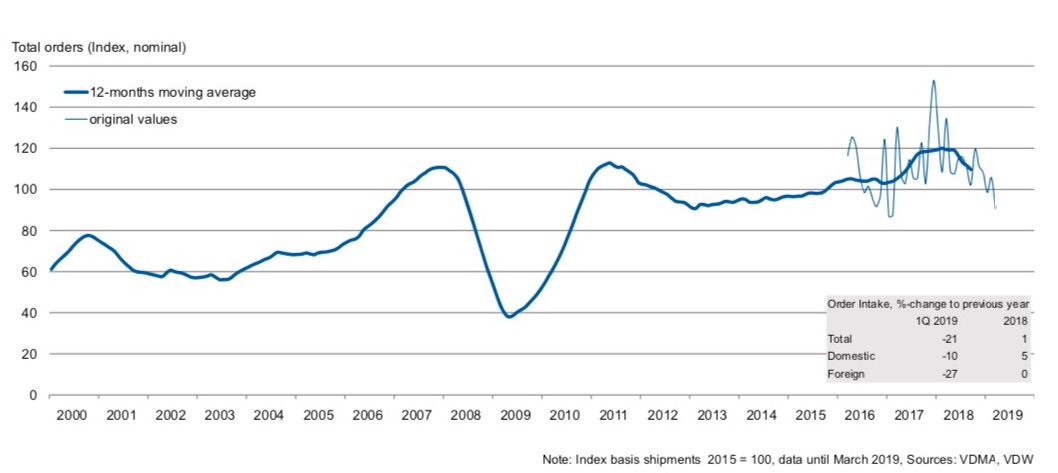

Orders received by the German machine tool industry in the first quarter of 2019 were 21% compared to the same period last year due to a cooling global economy and other challenges.

Orders received by the German machine tool industry in the first quarter of 2019 were 21% compared to the same period last year. Orders from Germany fell by 10% whereas those from abroad were down by 27%.

“These dips are due not least to the extremely buoyant first half of 2018,” said Dr. Wilfried Schäfer, Executive Director of the VDW (Verein Deutscher Werkzeugmaschinenfabriken – German Machine Tool Builders’ Association), Frankfurt am Main, commenting on the result. This base effect is expected to decrease significantly in the second half of 2019.

“Nevertheless, the cooling of the global economy is now finally impacting on the German machine tool industry, too,” Schäfer continued. Domestic business, long a counterweight to the decline in foreign orders, has lost a great deal of momentum. The only bright spot is the euro zone, which is now much more stable and saw only a 3% downturn. However, it can only stabilize the loss from the non-euro zone to a marginal extent.

Machine tool industry challenges

Reasons for the downturn include: Politically motivated disruptions to world trade which affect the emerging markets, weak growth in China, structural weaknesses in the automotive industry (the largest client market), and a slump in the semiconductor industry. “In 2018, the international automotive industry halved its capital spending to less than 4% compared with the previous year, and it is likely to plan an even lower figure for 2019,” Schäfer said.

Machine tool order levels are below those of sales for the first time again since mid-2014. Sales increased by 6% in the first three months of 2019. “Many companies are currently relying on their order backlog from the previous boom,” Schäfer said.

Excessive delivery times are also shortening again. This makes procurement more flexible again for customers and reduces plant production throughput times for manufacturers. Capacity utilization In April of this year was at 86.5%, which is below last year’s average.

“The VDW nevertheless expects production to grow by 1% in 2019,” Schäfer said. On the other hand, he is expecting demand to pick up in the second half of the year. The order backlog should also provide sustenance for some time to come.

– Edited from a VDW press release by CFE Media. See more Control Engineering CNC and motion control stories.