The Bundy Group reported 15 automation transactions in its February 2025 summary. Analysis on the acquisitions and reports are highlighted below including transactions from Ace Controls, Ati Motors, Motion Industries, RMH Systems and others.

February 2025 merger, acquisition, automation industry insights

- In the February 2025 monthly report to Control Engineering magazine and website, the Bundy Group, which helps with mergers, acquisitions and raising capital, reported 15 transactions.

- Companies included in the Bundy Group February 2025 report include Ace Controls, Bonsai Robotics Inc., Motion Industries, RMH Systems and SensorLogic, among others.

- Technologies involved include artificial intelligence (AI), robotics and manufacturing among others.

Bundy Group, an investment bank and advisory firm that specializes in the automation segment, provides an update on mergers and acquisitions and capital placement activity for this industry, with 15 February 2025 report transactions, involving Ace Controls, Bonsai Robotics Inc., Motion Industries, RMH Systems, SensorLogic and Zebra Technologies, among others. Technologies involved include AI, manufacturing robotics, sensing and others.

The Bundy Group said, “The automation market continues to experience a tremendous amount of mergers and acquisitions (M&A) and capital markets activity. Drivers of this activity include the growth-oriented nature of the automation market, the consolidation opportunities within the industry, and the strength of many of the companies operating within it. The automation market has attracted a critical mass of strategic buyers and financial sponsors (private equity groups, family offices, institutional investors) that are looking to own or invest in companies in the industry. From such Bundy Group closed automation transactions as CITI System Integrators and Ultimation, our team continues to see strong interest from a range of qualified buyers in the automation segment. Further evidence of the robust M&A and capital placement activity in automation is provided in the below list of transactions.”

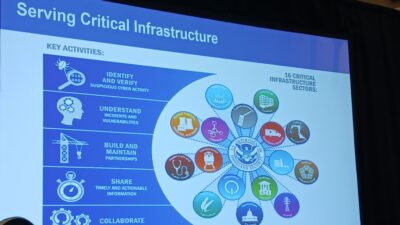

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence and cybersecurity. This serves as a leading indicator for submarkets the Bundy Group anticipates closed transactions in over the coming months and reporting in future updates here.

Bundy noted the following 15 transactions related to automation, controls or instrumentation in its February summary.

Motion Industries acquires Thompson Industrial Supply, Feb. 14

Motion Industries Inc. has signed a purchase agreement to acquire the net operating assets of Thompson Industrial Supply Inc. Family-owned since 1969 and based in Rancho Cucamonga, California, Thompson also has a location in South El Monte. The company distributes bearings, gear reducers, motors, hydraulics, industrial automation and pneumatics, along with providing in-house fabrication and belt shop services, including CNC machining, robotic welding, gearbox modification and custom hydraulic hose fabrication.

Acrew Capital raises capital for Moderne, Feb. 11

Moderne, specializing in automated code refactoring and analysis, has raised $30 million in a Series B round led by Acrew Capital, with participation from Morgan Stanley, Amex Ventures, TIAA Ventures and existing investors like Allstate, Intel Capital, Mango Capital and True Ventures. The Miami-based firm helps enterprises modernize and maintain large codebases, addressing technical debt and ensuring software remains secure and up-to-date.

Rotunda Capital Partners acquires RMH Systems, Feb. 11

Rotunda Capital Partners has invested in RMH Systems, a provider of material handling, packaging and automation solutions. The partnership, formed with the Howard family and existing leadership, positions RMH for accelerated growth and expanded market reach. Founded in 1936 and headquartered in Waukee, Iowa, RMH is a third-generation, family-owned business offering end-to-end solutions in material handling, packaging equipment and consumables, robotics and related MRO services.

McNally Capital acquires Jewett Automation, Feb. 11

McNally Capital, a private equity firm specializing in founder-, family-, and management-owned businesses in the lower middle market, has announced an investment in Jewett Automation. Jewett Automation is a leading manufacturer of filtration equipment and custom automation solutions, specializing in engineered manufacturing and robotic systems for complex industrial applications.

Gatekeeper Systems acquires FaceFirst, Feb. 7

Graham Partners, a private investment firm focused on advanced manufacturing and industrial technology, announced that its portfolio company, Gatekeeper Systems Inc., has acquired FaceFirst Inc. Headquartered in Austin, Texas, FaceFirst is a leading provider of AI-enabled facial recognition solutions aimed at reducing shrink and enhancing safety for retail customers.

Mercer Midwest acquires Rocky Mountain Electrical Specification, Jan. 1

Mercer Midwest is acquiring Rocky Mountain Electrical Specifications and merging the business into Mercer Midwest, effective Jan. 1. Both companies will continue to operate independently and with the same contact information until that date. Along with this acquisition, the company changes its name to Orion Innovation Partners Inc. Orion will provide control and automation systems throughout the Great Lakes and Rocky Mountain Regions.

Platte River Equity acquired Building Controls & Solutions, Feb. 3

Platte River Equity, a Denver-based private equity firm, has acquired Building Controls & Solutions (BCS) from LKCM Headwater Investments. BCS is a value-added distributor of building automation solutions, offering products and services that optimize building performance, enhance energy efficiency and improve occupant comfort.

Excelis Packaging Automation acquired Marks Machinery, Jan. 30

LFM Capital announced that its portfolio company, Excelis Packaging Automation, has acquired Marks Machinery. Excelis, a provider of turnkey automation solutions, has grown into a full-service packaging automation platform through five add-on acquisitions since LFM’s initial investment in 2021, further expanding its capabilities in the industry.

Belt Power acquired Sparks Belting Co., Jan. 15

Belt Power LLC has acquired the U.S. assets of Sparks Belting Co., a Grand Rapids, MI-based distributor and fabricator of conveyor systems. The acquisition combines Belt Power’s national network and automated operations with Sparks’ engineering expertise, creating a leading platform for delivering cost-saving solutions and exceptional service across the U.S.

Bison Ventures funded Bonsai Robotics, Jan. 28

Bonsai Robotics Inc., a leader in physical AI solutions for agriculture, has raised $15 million in Series A funding, led by Bison Ventures with participation from Cibus Capital and existing investors. The funding will support Bonsai in enhancing its software, expanding its AI platform, driving original equipment manufacturer partnerships and accelerating commercialization efforts.

Blackford Capital acquired Ace Controls, Jan. 27

Blackford Capital, a leading lower middle market private equity firm, acquired Ace Controls, a Houston-based company known for designing and building industrial control panels. This acquisition expands Blackford’s Industrial Automation Platform, PACIV, to serve a wider customer base. Ace Controls marks the third acquisition for PACIV since its launch in June 2023, following Data Science Automation in January 2024 and Eight12 Automation in May 2024.

Walden Catalyst Ventures & NGP Capital funded Ati Motors, Jan. 23

Ati Motors raised $20 million in Series B funding led by Walden Catalyst Ventures and NGP Capital, with participation from other investors. The investment follows strong Q4 2024 growth, tripling its order book and adding nine clients. Ati Motors specializes in AI, robotics and manufacturing, with hundreds of Sherpa robots deployed across 40 top manufacturers, including Forvia and Hyundai.

Zebra Technologies acquired Photoneo, Dec. 30, 2024

Zebra Technologies have acquired Photoneo, a leader in 3D vision and AI robotics. Founded in 2014, Photoneo specializes in robotic vision sensors and intelligence software, powered by its patented parallel structured light technology. The acquisition enhances Zebra Technologies’ portfolio with advanced, high-resolution and fast solutions that integrate seamlessly with many top robotic manufacturers, particularly in robot-arm applications.

Creandum and Point Nine & Air Street Capital funded Sereact, Jan. 20

https://sereact.ai/posts/sereact-fundraising-series-a

Sereact has secured 25 million euros in Series A funding to advance AI-driven robotics. The round was led by Creandum, with participation from Point Nine, Air Street Capital and notable investors, including former Formula 1 champion Nico Rosberg. This investment underscores the growing potential of AI in robotics and the confidence industry leaders have in Sereact’s vision.

R.M. Young Company acquires SensorLogic, Jan. 17

https://benfordcapital.com/r-m-young-company-completes-acquisition-of-sensorlogic-inc

Benford Capital Partners and its portfolio company, R.M. Young Company, have acquired SensorLogic Inc., a provider of radar-based sensors for environmental applications. Founded in 2006 and based in Bozeman, MT, SensorLogic specializes in snow-depth measurement, including its SNOdar sensor used by avalanche centers and water resource managers. The acquisition expands R.M. Young’s portfolio of solutions for measuring wind speed, temperature, humidity and rainfall.

ONLINE extra: Bundy Group is a boutique investment bank that specializes in representing automation, systems integration, industrial technology, internet of Things and cybersecurity companies in business sales, capital raises and acquisitions. Over the past 35 years, Bundy Group has advised and closed on over 250 transactions, which includes numerous automation-related transactions.

Clint Bundy is managing director, Bundy Group, which helps with mergers, acquisitions and raising capital. Edited by Mark T. Hoske, editor-in-chief, Control Engineering, WTWH Media, [email protected].

ONLINE

Latest automation mergers, January 2025