Research: “The State of Industrial Automation” is a spring 2025 report with a fresh look at industry trends and outlook. Watch for related coverage throughout the year.

State of Industrial Automation 2025 report insights

- Understand that the ‘State of Industrial Automation,” spring 2025, report provides a fresh look at industrial automation industry trends and outlook. Link to the full report.

- Learn about industrial automation technologies investments, motivations and barriers to industrial automation investments.

- Explore how industrial automation helps shifting workforce demographics and the research methods and demographics for State of Industrial Automation report.

The State of Industrial Automation report, spring 2025, analyzes how this dynamic sector is reshaping industries worldwide. This report offers Control Engineering survey results and data analysis, with actionable insights for manufacturers, technology vendors and policymakers striving to thrive in an era of rapid technological change.

The automation industry continues to be defined by innovation and pragmatism. Below, see research methods, demographics for State of Industrial Automation report.

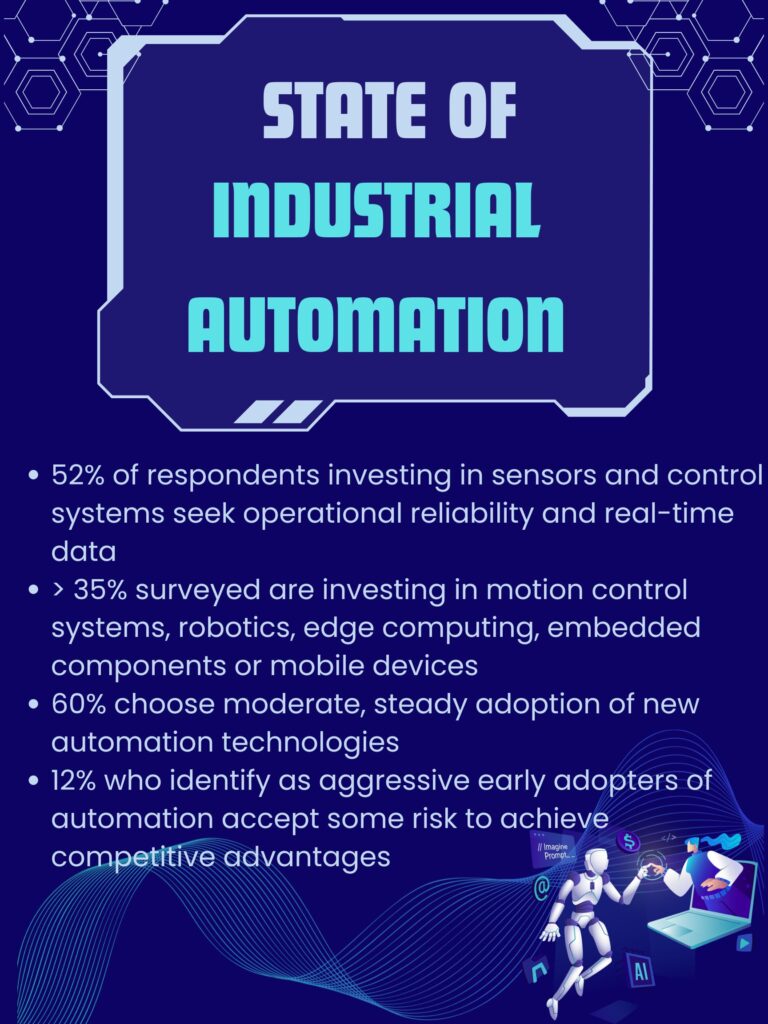

Automation technologies investments

Investments in foundational technologies like sensors and control systems dominate priorities with 52% of survey respondents investing in each as organizations seek operational reliability and real-time data insights. Fewer than 35% of those surveyed are investing in motion control systems, robotics, edge computing, embedded components or mobile devices, at present, perhaps reflecting concerns over return on investment (ROI) and system integration challenges. Vendors can address these hesitations by demonstrating cost-effectiveness and seamless interoperability with existing systems.

More than half of respondents (60%) choose moderate, steady adoption of “new automation technologies” with an ROI focus. The 28% characterizing themselves as conservative automation adopters (risk averse, minimal adoption) may see budget constraints and perceived complexity as barriers (see barriers, below). However, the 12% of survey respondents who identify as aggressive early adopters of leading-edge automation demonstrate willingness to accept some risk to achieve competitive advantages.

Why invest in automation?

The key drivers (respondents could select up to three) behind automation investments highlight operational efficiency and cost reduction (69%), alongside priorities like product quality and consistency improvements (45%) and safety enhancements (37%). Standards for digitalization, efficiency, interoperability and regulatory compliance (17%) are motivators, along with environmental sustainability (12%) and supply chain resilience (4%), indicating positive business benefits of global climate commitments and the need for robust, responsive operations.

Overcoming barriers to automation investments

However, barriers, such as high implementation costs (55%), legacy system integration (44%) and workforce skill gaps (35%), remain significant. Addressing these challenges will require innovative pricing models, robust support structures and training programs to prepare the workforce for advanced systems. With a large lead (about 25 percentage points), the most significant technologies with the most significant impact on workforce productivity and emerging technologies seen most critical to future success are advanced process control and control system optimization.

Adoption of artificial intelligence (AI)-driven predictive models, autonomous robotics and edge computing is transforming manufacturing operations, available to improve real-time decision-making, autonomous workflows and increased levels of operational visibility.

Yet, these innovations remain underused, reflecting opportunities for vendors to drive awareness and adoption through targeted education and pilot programs.

Automation helps shifting workforce demographics

The workforce is undergoing profound shifts, with 44% of respondents highlighting the creation of high-skill roles and 35% emphasizing the need for remote monitoring capabilities. As automation reduces low-skill labor demand, industries must address the growing skills gap through upskilling and cross-functional training.

The industrial automation sector stands at a pivotal juncture. To capitalize on opportunities, industry leaders must embrace strategies that drive adoption, tackle workforce challenges and align with sustainability goals. For manufacturers, staying ahead means turning barriers into steppingstones and leveraging innovation to achieve operational resilience, quality and sustainability.

Research methods, demographics for State of Industrial Automation report

In the January email survey of Control Engineering subscribers, 122 responses were received, including 104 complete responses for a margin of error of plus or minus 8.9%. Respondents include 45% end-user engineers or system integrators, and more than three-quarters were from locations with fewer than 250 people. Chat GPT assisted in shaping this report.

Mark T. Hoske is editor-in-chief, Control Engineering, WTWH Media, [email protected].

ONLINE

Read more from the Control Engineering “The State of Industrial Automation” 2025 report.