The Bundy Group reported nine automation transactions in its June 2025 summary reports. Analysis on the acquisitions and reports are highlighted below including transactions involving ECS Solutions, EnergyDrive Systems, E Tech Group, Flowserve and Gecko Robotics and others.

June 2025 merger, acquisition, automation industry insights

- In the June 2025 monthly report to Control Engineering magazine and website, the Bundy Group, which helps with mergers, acquisitions and raising capital, reported nine transactions.

- Companies included in the Bundy Group June 2025 reports include ECS Solutions, EnergyDrive Systems, E Tech Group, Flowserve, Gecko Robotics, among others.

- Technologies involved include control system integration, drives and robotics among others.

Bundy Group, an investment bank and advisory firm that specializes in the automation segment, provides an update on mergers and acquisitions and capital placement activity for this industry, with nine June 2025 report transactions, involving ECS Solutions, EnergyDrive Systems, E Tech Group, Flowserve and Gecko Robotics, among others. Technologies involved include control system integration, drives, robotics and others.

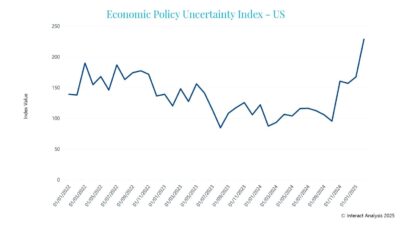

The Bundy Group said, the automation market continues to experience many mergers and acquisitions (M&A) and capital markets activities. Drivers of this activity include the growth-oriented nature of the automation market, the consolidation opportunities within the industry, and the strength of many of the companies operating within it. The automation market has attracted a critical mass of strategic buyers and financial sponsors (private-equity groups, family offices, institutional investors) that seek to own or invest in companies in the industry. From such Bundy Group closed automation transactions as CITI System Integrators and Ultimation, and the team continues to see strong interest from a range of qualified buyers in the automation segment. Further evidence of the robust M&A and capital placement activity in automation is provided in the transactions listed.

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence and cybersecurity. This serves as a leading indicator for submarkets the Bundy Group anticipates closed transactions in over the coming months and reporting in future updates. Bundy noted the following transactions related to automation, controls or instrumentation in its June summary for Control Engineering.

Cox Enterprises funded Gecko Robotics, June 12

Gecko Robotics, an AI and robotics company focused on critical infrastructure, has raised a Series D funding round at a $1.25 billion valuation, double its previous valuation. Cox Enterprises lead the $125 million investment, alongside existing investors USIT, XN, Founders Fund and YCombinator. The capital will support Gecko’s expansion across key sectors such as defense, energy and manufacturing, following recent partnerships with NAES, L3Harris and Abu Dhabi National Oil Co.

ProMach acquired DJS Systems, May 30

ProMach, a global provider of processing and packaging machinery, has acquired DJS Systems, a U.S.-based automation provider specializing in disposable food service packaging. Founded in 2003 by David Swope, DJS is recognized for its innovative solutions and strong partnerships with top packaging providers. The acquisition expands ProMach’s capabilities in the disposable food service packaging sector.

Chart Industries agrees to merge with Flowserve, June 3

Chart Industries [engineering equipment and services for industrial gas markets] and Flowserve [flow control and fluid motion products] have entered into a definitive agreement to merge in an all-stock transaction, forming a $19 billion industrial process technology company. With an installed base of more than 5.5 million assets in more than 50 countries, the combined company will address the full customer lifecycle from process design through aftermarket support.

Pears Partnership Capital funded EnergyDrive Systems, June 2

Energy Drive Systems, an English subsidiary of Apogee Sustainability Ltd. and a provider of energy efficiency for large motors in the mining, metals and utilities industries, has secured a strategic growth investment of $20 million from The Pears family, a financing and real estate group based in London. Information came from a June 2 press release from the Cardew Group.

Amprod acquired Simmtech Process Engineering, May 15

Amprod has acquired Simmtech Process Engineering, a Canadian systems integrator recognized for its technical expertise and strong customer relationships across North America. The acquisition expands Amprod’s presence in Canada and strengthens its ability to deliver comprehensive automation and smart manufacturing solutions. Simmtech will now operate as Simmtech Process Solutions, part of EnSight Solutions, Amprod’s division focused on hygienic food processing systems.

Magnum Systems acquired ECS Solutions, Feb. 28

Magnum Systems acquired ECS Solutions, expanding its family of brands and strengthening its ability to deliver end-to-end, customized industrial manufacturing implementations. With more than 110 years of combined industry expertise, the integration of ECS enhances Magnum’s position as a CSIA-certified provider of batch and process control automation, control systems integration and manufacturing execution systems.

E Tech Group acquired JSat Automation, May 28

E Tech Group acquired JSat Automation, a Pennsylvania-based system integrator specializing in automation, IT/OT convergence and compliance. JSat will operate as “JSat, an E Tech Group Company,” with founder Jeetu Satpute joining E Tech’s leadership team. This is E Tech’s third acquisition since 2023, following E-Volve Systems and Automation Group.

Addtronics acquired DAC International, May 29

Addtronics acquired DAC International, a manufacturer of ultra-precision equipment for contact lens and intraocular lens (IOL) production. Based in Carpinteria, California, DAC designs and builds advanced systems that address the complex demands of lens manufacturing. The acquisition strengthens Addtronics’ portfolio in the life sciences sector and expands its capabilities in precision automation for medical device manufacturing.

Fusion Capital Partners acquired Relevant Industrial, May 19

Fusion Capital Partners a private investment firm specializing in engineered products and services within the industrial sector, acquired Relevant Industrial, a provider of industrial equipment and engineered solutions, from LKCM Headwater Investments. Fusion will hold majority ownership in the company with LKCM remaining as a minority partner.

Clint Bundy is managing director, Bundy Group, which helps with mergers, acquisitions and raising capital. Edited by Mark T. Hoske, editor-in-chief, Control Engineering, WTWH Media, [email protected].

ONLINE

Search on Bundy at www.controleng.com for more merger and acquisition news.

Control Engineering provides more information about automation and industries applying automation.