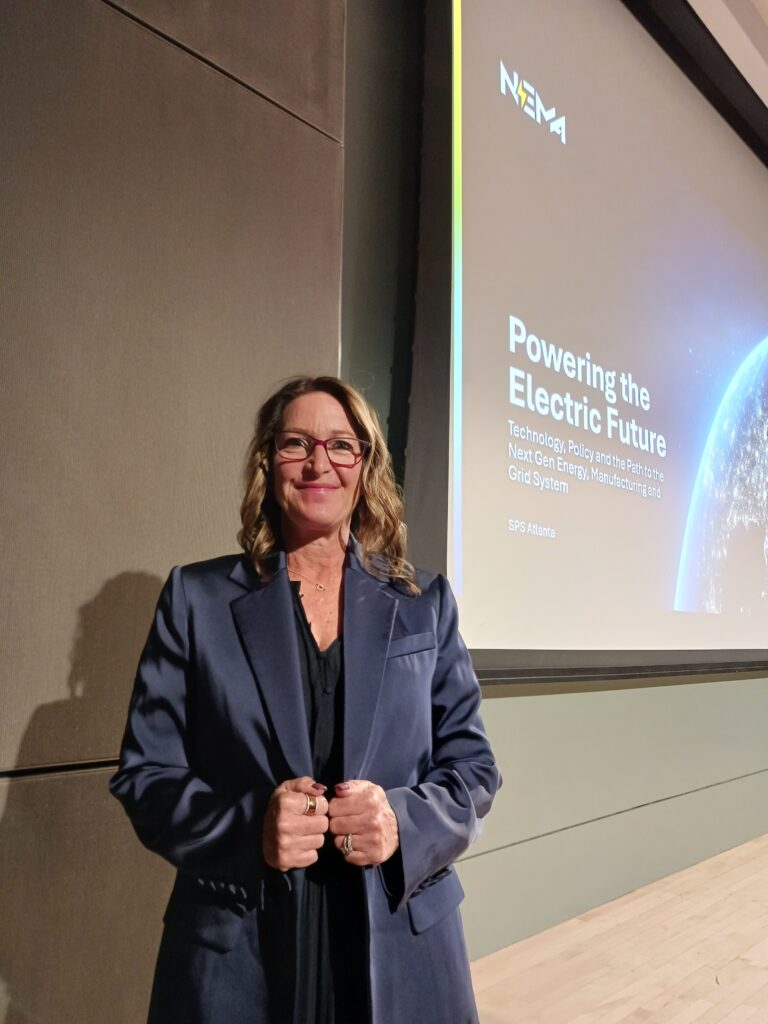

NEMA president and CEO Debra Phillips discussed “Powering the Electric Future: Technology, policy and the path to the next gen energy, manufacturing and grid system” in the opening keynote presentation at SPS Atlanta 2025, covering tariffs, trade, technologies and other topics.

NEMA electroindustry insights at SPS Atlanta 2025

- NEMA president and CEO Debra Phillips discussed “Powering the Electric Future: Technology, policy and the path to the next gen energy, manufacturing and grid system” in the opening keynote presentation at SPS Atlanta 2025.

- NEMA sees electroindustry growth, especially data centers, buildings, electric vehicles and industrial growth; trade challenges include new tariffs and NEMA is helping the industry work through rapidly changing policies.

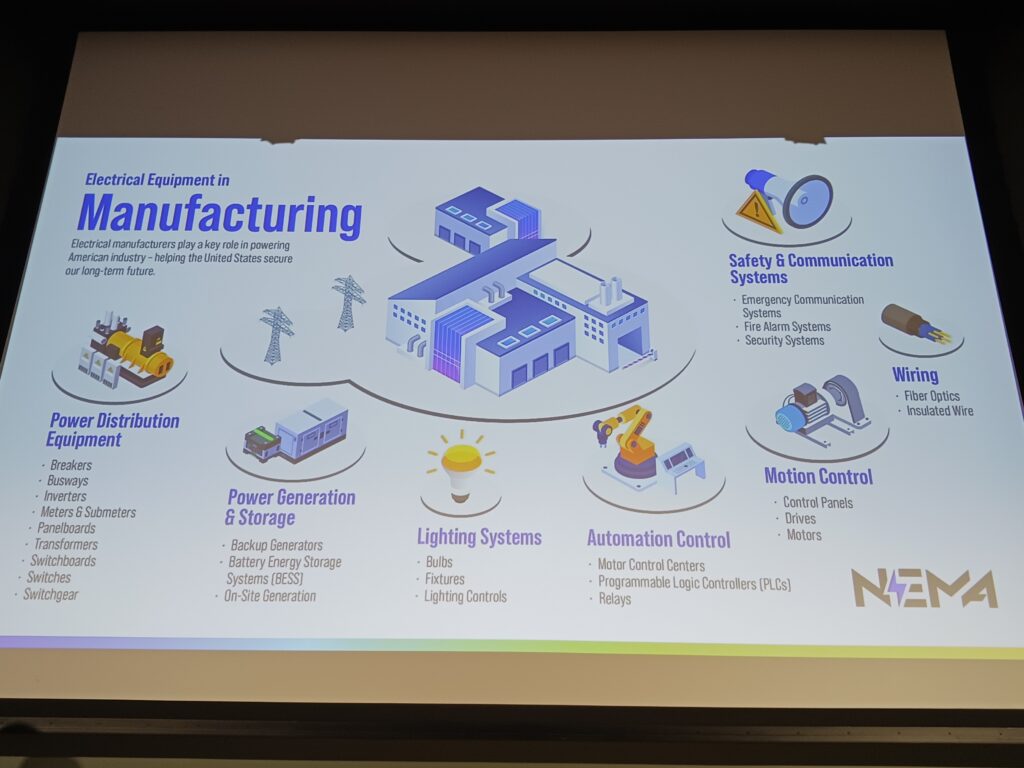

- Electroindustry expansion efforts include smart manufacturing fueled by automation.

Energy production and use, U.S. manufacturing, grid modernization, electrical standards and electroindustry workforce advocacy were among topics covered in the opening keynote presentation at SPS Atlanta 2025. The National Electrical Manufacturers Association (NEMA) president and CEO Debra Phillips (Figure 1) discussed “Powering the Electric Future: Technology, policy and the path to the next gen energy, manufacturing and grid system” in a Sept. 16 presentation. NEMA is an advocacy, standards development industry association based in Washington, D.C.

Electroindustry: Connected, resilient, sustainable

The advocacy and standards development association will be 100 in 2026 and has produced about 1000 standards. Phillips has been with the organization four years and works to help create a more electric, connected, resilient and sustainable world in cooperation with more than 300 member companies. The business from those electroindustry companies equal the number 2 importer and number 2 exporter, second only to automotive. Members are responsible for 580,000 U.S. jobs and 1% of U.S, gross domestic product (GDP) across industries responsible for generation, transmission, distribution and end use of electricity (Figure 2). A 30-member board includes major automation companies.

Competitive electrical technologies

NEMA technical standards are ANSI-accredited and cover safety, efficiency and interoperability, Phillips said. These include NEMA motor efficiency standards responsible for considerable U.S. cost savings through more efficient and effective energy use.

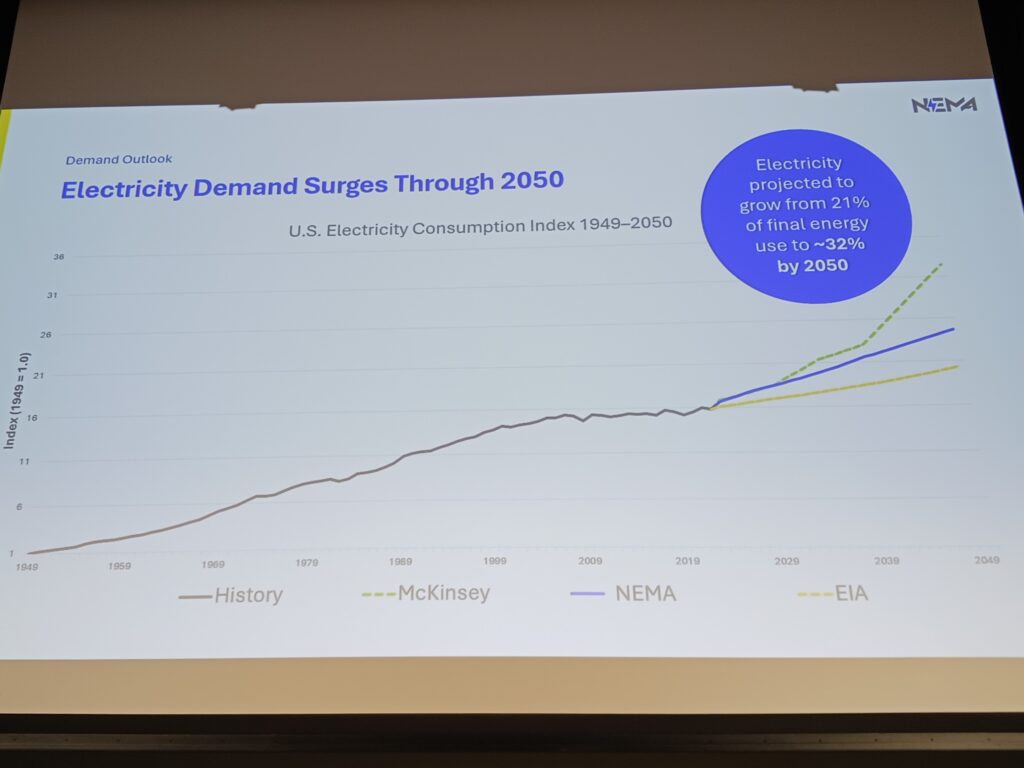

Macro trends affecting NEMA members include energy evolution of the electrical grid, need for greater electrical capacity to serve artificial intelligence (AI) servers, electrical resiliency and additional electrical flexibility. A grid study published in April shows NEMA demand prediction between two other organizations (Figure 3). Accelerated electrical use is driven by transportation electrification with standards and policies. She noted that with appropriate controls electric vehicles (EVs) can help with peak demand as system evolves to allow flow of electrons back to grid when needed.

Electrical industry growth

NEMA is helping to facilitate data center efficiency and promote building efficiency. The organization works to advance all energy system solutions with tax and policy approaches (using faster online processes than used in the past). NEMA promotes permitting reform for generation, transmission and distribution. The NEMA grid study provides details about the growth in demand to 2% to 3% per year, adding up to 50% demand growth through 2050. There’s a greater need for investment in all energy technologies to meet demand with energy ecosystem that uses all available sources because electricity is projected to grow from 21% of final energy use to approximately 32% of final energy use by 2050, NEMA said. Policy instruments must support America’s energy systems, Phillips said.

Data centers, buildings, EVs, industrial growth

Electrical growth over the next 10 years is driven by a 300% increase in the number of data centers with artificial intelligence (AI) capabilities, growth in commercial buildings and residential housing, a 9000% increase in electric-vehicle power needs and a 58% increase in electrical demand from industrial uses. Energy storage coupled with wind and solar generation is expected to grow 300%. Growth varies by region because electrical regions have been separated into regions for reliability reasons, Phillips said. The locations of data centers and EV expansion will create uneven growth, as maps by North American Electrical Reliability Council (NERC) region show.

NEMA 2025 deliverables related to data centers cover technical standards, industry collaboration and sustainability, Phillips said.

Participating in events helps NEMA create awareness of how electrical industry investments create U.S. growth: $185 billion in U.S. growth can be attributed to electrical industry new manufacturing investments since 2018. Including investment related to the grid and AI, that increases to $1.4 trillion.

A second large macro trend affecting NEMA members and the U.S. is supply chain certainty. NEMA is working to influence trade policy, shape and facilitate compliance with trade-based domestic content rules. NEMA continues to advocate for workforce development and explain policy effects on key constrained materials and facility materials management.

Electroindustry is second only to automotive

Phillips said the Biden Administration’s $1.2 trillion infrastructure bill included $400 billion investment in infrastructure for the electrical industry including industrial. NEMA helping to work out the domestic content requirements part of those investments.

NEMA’s helping with the workforce future in supply chain issues across industries, including material use. When federal agencies move regulation to states, that creates a patchwork of regulations, making compliance more difficult. “The electroindustry global supply chain” is among the most complex, Phillips said, with 12 harmonized system chapters (classifications for global trade and customs), 65 tariff headings, 311 six-digit tariff subheadings and 1027 10-digit statistical reporting numbers (Figure 4).

NEMA said the electroindustry was the second-largest exporter of manufactured goods from the U.S. (excluding oil and gas, counted as a natural resource) in 2024, behind the automotive industry, and ahead of aircraft, pharmaceuticals, metals, chemicals, food and beverage and textiles and footwear. As for imports, the electroindustry also is behind automotive, and ahead of metals, textiles and footwear, food and beverage, pharmaceuticals, chemicals and aircraft.

Electroindustry trade: exports, imports

Looking at the share of 2024 U.S. electroindustry trade by partner based on value, for exports, it’s 26.1% Mexico, 16.9% Canada, 6.2% China, 5.3% Germany, 3.4% Japan and $42.1% all others.

For imports, it’s 22.9% Mexico, 17.8% China, 6.4% Japan, 6.2% Germany, 5.3% Vietnam and 41.5% all others.

Looking at the share of electroindustry imports, from 2018 to 2024, Mexico’s share of U.S. imports has remained relatively stable, Phillips said, decreasing 0.6 percentage points to 23.2%. China’s share of U.S. imports has declined substantially, down 9.1 percentage points from 2018 to 2024 to 18.9%.

In 2024, the U.S. trade deficit was -$1,203 billion, 11.9% was electrical at -$143.3 billion.

By trading partner, top 10 deficits* follow:

1. China -$295.4 billion, 14.2% electrical at -$42 billion

2. EU -$235.6 billion, 9.2% electrical at -$21.6 billion

3. Mexico -$171.8 billion, 16.4% electrical at -$28.3 billion

4. Vietnam -$123.5 billion, 11.8% electrical at -$14.6 billion

5. Taiwan -$73.9 billion, 7.9% electrical at -$5.8 billion

6. Japan -$68.5 billion, 19.7% electrical at -$13.5 billion

7. South Korea -$66.0 billion, 12.6% electrical at -$8.3 billion

8. Canada -$64.2 billion, -16% electrical at $10.2 billion*(surplus)

9. India -$45.7 billion, 9.5% electrical at -$4.3 billion

10. Thailand -$45.6 billion, 21% electrical at -$9.6 billion.

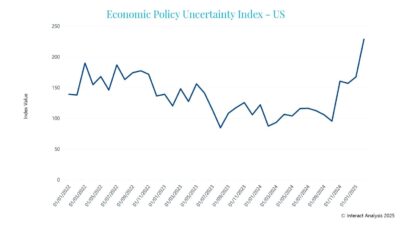

NEMA has tracked and explained more than 20 Trump administration trade announcements, Feb. 1 to Aug. 21, 2025, many with extensive electroindustry impacts. The last three were:

- Aug. 1, a 50% tariff of semi-finished copper goods and copper derivatives

- Aug. 15: Section 232 steel and aluminum tariff inclusion announcement. 407 HTSUS product codes included effective Aug. 18, 2025 [includes transformers, already constrained]

- Aug. 21: U.S.-EU trade framework. 15% reciprocal tariff on EI goods. EU tariffs on U.S. removed or lowered.

Needed grid modernization and other electroindustry expansions are more challenging with tariffs, Phillips said. If manufacturers do not calculate copper, aluminum and steel content, then imports are subject to the maximum 50% tariff, a burden to business seemingly counter to the administration’s stated goals of less regulation, Phillips said. Anticipated annual cost of compliance for the electroindustry is estimated at $2 billion, Phillips said, including transformers, switchgear, electrical steel, semiconductors and chips and critical minerals.

Targeted incentives that could help include capital investments in U.S. manufacturing capacity within three years of when the facility is operational. This could help power infrastructure (generation, transmission, distribution, storage and data centers) and domestically produced content that meet domestic content requirements, carrots to go with the tariff sticks, she said.

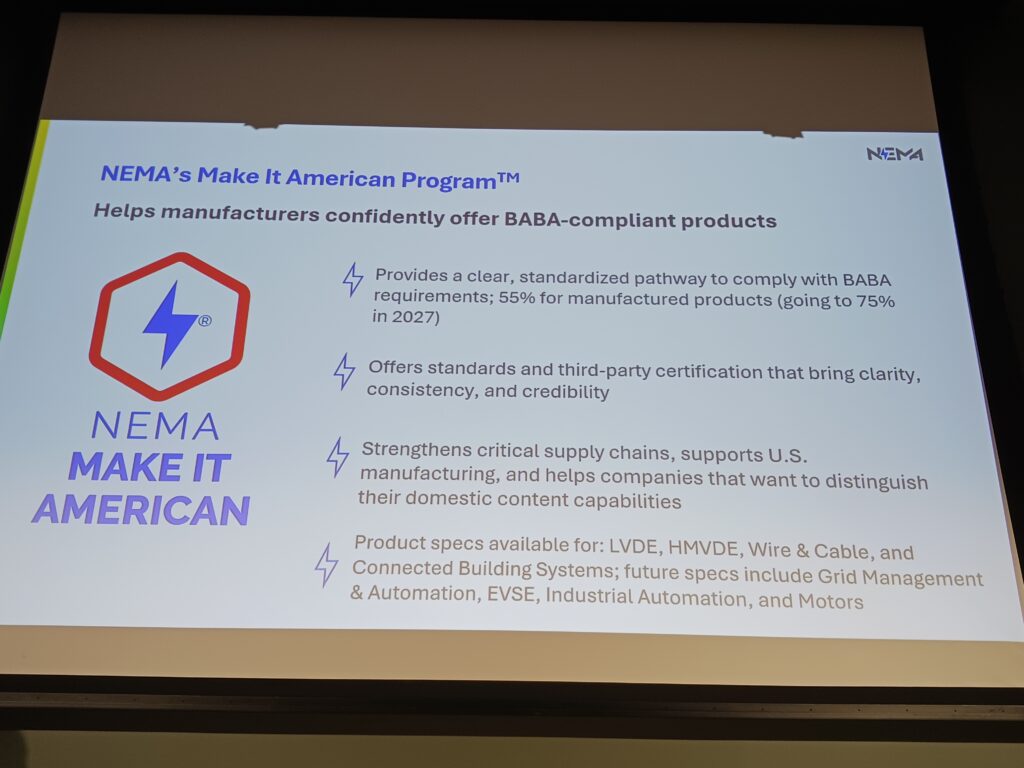

Electroindustry certification helps compliance

In spring 2025, NEMA launched a certification for the NEMA Make it American program to help companies with the Build America Buy America (BABA) product compliance requirements, 55% for manufactured products increasing to 75% in 2027 (Figure 5). Product specifications are available for low-voltage distribution equipment (LVDE), high- and medium-voltage distribution equipment (HMVDE), wire and cable and connected building systems. Future specifications include grid management and automation, electric vehicle supply equipment (EVSE), industrial automation and motors. Without measurements, companies with stated content require the tariff. Included in the https://makeitamerican.org/registry are Eaton, Master, Schneider Electric, Siemens, Southwire and Tesco, among others.

Workforce shortfalls in electroindustry; expansion efforts

Workforce demographics are creating additional shortages in electroindustries. Electricians, Phillips said, are retiring at a rate of 10,000 per year and entering the workforce at 3,000 per year.

NEMA is working with other associations (NAED, NEMRA and NECA) to help military veterans transition to an electroindustry career. NEMA also is working on an emerging leaders program to bring more attention to the benefits of electroindustry careers.

Smart manufacturing, role of automation

Phillips said 56% of manufacturers are piloting smart manufacturing, 20% are doing so at scale, 20% plan future smart manufacturing investments; 95% plan AI/machine learning (ML) and generative AI investments by 2030, citing Rockwell Automation “Current State of Manufacturing” research. Top uses for AI/ML in the next 12 months are quality control, cybersecurity, process optimization, robotics and logistics, the research said.

The administration wants more state-of-the-art manufacturing in the U.S. To help with advanced manufacturing, NEMA is

- Developing and advanced manufacturing standards roadmap to harmonize interoperability and safety.

- Collaborating with the Advanced Manufacturing Council, federal agencies, trade groups and academia to guide U.S. leadership.

- Promoting visibility efforts to reach manufacturers, policymakers and innovators.

These will help with interoperability and efficiency issues, helping those involved to scale, grow and use advanced manufacturing technologies more effectively by raising the profile and promise of automation.

The NEMA Smart Manufacturing Coalition aims to:

- Accelerate innovation and adoption by reducing barriers to innovation and speed implementation.

- Address interoperability challenges by creating protocols and best practices to ensure systems and technologies are interoperable, scalable and security.

- Strengthen workforce and economic resilience by developing shared training programs to help manufacturers upskill employees to digital transformation, enhance competitiveness and improve supply chain resilience.

2026, NEMA’s centennial year, will include efforts to create a stronger U.S. energy system and a larger manufacturing sector by emphasizing the essential electroindustry role that domestic electrical manufacturing powers the economy of tomorrow. NEMA-driven coalition, advocacy, policy, and technology solutions will accelerate innovation and growth, Phillips said: “Make it electric.”

Audience electroindustry questions, answers

Phillips answered some audience questions after her presentation.

Responding to a question about power generation sources, she acknowledged that U.S. offshore wind projects are meeting resistance from the current administration at a time when all power generation sources are needed. On-shore wind and solar projects are underway, part of a large and needed increase in renewables. She noted that permitting for those new renewable sources is easier than fossil-plant permitting. Several retired baseload nuclear plants are expected to return to generation, and new designs of small modular nuclear generating plants are expected, but seem unlikely to be a large part of the near-future power generation mix.

Responding to a question about the sustainability of data centers, Phillips said data center technologies are rapidly advancing, noting that designs vary by cooling technology and type of data center.

About cybersecurity, Phillips said NEMA is involved in standards efforts and with CISA, especially as more assets connect to the electrical grid and applications for controls increase. Utilities are asking NEMA to do more, Phillips said, especially to help alleviate risk related to Chinese products that may be required as the lowest bidder for some projects, but may not comply with the U.S. cybersecurity framework.

About NEMA motor control standards, Phillips noted that technologies vary because of differences in global electrical supplies and added that NEMA is working to harmonize standards internationally where possible.

On manufacturing careers, Phillips said many manufacturers work with local trade colleges but added that NEMA is encouraging a national focus to raise the level of discourse on manufacturing careers.

Control Engineering asked if less trade and tariff uncertainty would help the electroindustry. Phillips acknowledged it’s been a challenging year to date but noted continued investments in U.S. manufacturing from multiple industry leaders including Schneider Electric and Hitachi, among others. It’s a wait-and-see attitude for some, adding that NEMA’s program to help with domestic content requirements is designed to help. Canada and Mexico have been strong trade partners and must find a way to continue and expand North American free trade, she said, with renewed negotiations underway in September.

She said NEMA is very optimistic about continued growth of the electroindustry with opportunities for stronger investments in policy, electrical grid generation, transmission and distribution, AI and onshoring. Automation technologies will play a larger role in all electroindustry areas, she predicted, as workforce shortages continue.

Workforce, tariff and certification information from NEMA

NEMA provides more on the following topics. [Note: The NEMA website changed from https://www.nema.org to https://www.makeitelectric.org.]

NEMA workforce development

NEMA tariff proposals

NEMA certification to help with automation and material origin requirements

NEMA copper-related tariff advice

Mark T. Hoske is editor-in-chief, Control Engineering, WTWH Media, [email protected].

Keywords

Automation, electroindustry, NEMA, SPS Atlanta 2025, U.S. competitiveness, advanced manufacturing

Consider This

Are you using NEMA resources to help with changing technologies and policies in the electroindustry?

You also might like

Control Engineering automation market research is available.