The approach Infor is taking to service-oriented architecture (SOA) should come as no surprise to anyone familiar with manufacturing software markets because it aligns well with the third-largest enterprise vendor's acquisitive business strategy, and is meant to play well with its 70,000 customers worldwide.

The approach Infor is taking to service-oriented architecture (SOA) should come as no surprise to anyone familiar with manufacturing software markets because it aligns well with the third-largest enterprise vendor’s acquisitive business strategy, and is meant to play well with its 70,000 customers worldwide.

Yet while Infor senior management has gone to great lengths to position the strategy in sharp contrast to SAP and Oracle—the two vendors Infor is chasing—it’s not yet clear how it will be received in the general market.

“Unlike SAP and Oracle, they’re not going to create one platform everyone has to move to,” says Bob Mick, VP of emerging technology for Dedham, Mass.-based ARC Advisory Group . “That’s important to their business strategy. Infor has a lot of customers on a lot of different products, and it would be difficult to choose one common platform—and a disaster to tell everyone to switch to it.”

According to Infor CEO Jim Schaper, “Infor OPEN SOA is a technical expression of our business model that allows rapid introduction of our acquisitions.” Contrasting Infor’s strategy starkly with its competitors—which he says are “focused on complex middleware platforms” Shaper adds, “We will not leave customers behind, or put them on a forced march to convert to a platform.”

Integral to the strategy is delivering functional enhancements and upgrades to the panoply of existing solutions as part of its regular maintenance program, making new modules or services SOA-enabled.

“Infor is saying, let each application evolve independently as a total system, and as a network of applications we’ll guarantee that they work together—not that they all have the same technology internally,’” says Ian Finley, a director with Boston-based AMR Research . “As a business strategy, that puts them in a good position to keep acquiring companies and adding to their catalogue of applications, while SAP and Oracle are faced with rewriting and integrating applications into a new architecture. Customers can leave Infor applications in place and buy new SOA applications that will integrate with the old, but they won’t be forced to upgrade just because they want to take advantage of some new functionality.”

Though Finley stresses the distinctions between vendor strategies aren’t quite as simple as that, he says SAP’s and Oracle’s strategies are more grounded in the idea of large enterprise customers going through major system refreshes every five to 10 years.

“I think some will want all applications built on the same technology, and that it’s easier to believe it will all work together properly. Others will want to leave the pieces in place and upgrade only what will help the business,” says Finley.

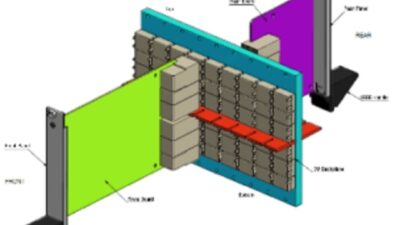

Finley likens SAP’s and Oracle’s approaches to buying an all-in-one cabinet stereo system, while Infor’s approach involves buying components with standard jacks on the back to add components as desired.

“Some will like the SAP and Oracle approach; some will prefer Infor,” he says. “Infor says it is taking applications that don’t have standard backplanes and reworking them in new ways to make them work together.”

While Finley concedes that Infor is doing the right thing for the customer, “I don’t know yet that it will create a market stampede in their direction. Our approach at AMR is that SOA provides tools and plumbing that can make applications better, but in the end it’s how you apply them—rather than the techniques inside.”