The Bundy Group reported 21 automation transactions in the month of August. Analysis on the acquisitions and reports are highlighted below.

Bundy Group, an investment bank and advisory firm, provides an update on mergers & acquisitions and capital placement activity for companies that address the manufacturing and plant management fields.

The automation market continues to experience a tremendous amount of mergers & acquisitions (M&A) and capital markets activity. Drivers of this activity include the growth-oriented nature of the automation market, the consolidation opportunities within the industry, and the strength of many of the companies operating within it. Furthermore, the automation market has attracted a critical mass of strategic buyers and financial sponsors (i.e. private equity groups, family offices, institutional investors) that are looking to own or invest in companies in the industry. From such, Bundy Group closed automation transactions as Ultimation and MR Systems, our team continues to see strong interest from a range of qualified buyers in the automation segment. Further evidence of the robust M&A and capital placement activity in automation is provided in the below list of transactions.

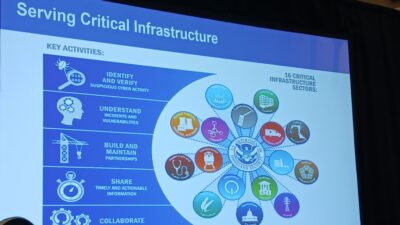

Bundy Group’s current engagements and owner relationships include control system integration, robotics, automated material handling, automation distribution, artificial intelligence, and cybersecurity. This serves as a leading indicator for submarkets our team anticipates closed transactions in over the coming months. We look forward to providing these relevant updates and transaction announcements to Control Engineering magazine readers.

July 2024 automation transactions

8/15/24

MidOcean Partners , a premier New York-based alternative asset manager specializing in middle-market private equity, structured capital, and alternative credit investments, acquired SI Solutions, a leading provider of engineering, testing, inspection, compliance and maintenance services, digital solutions, and expert consulting for power and critical infrastructure end markets. Learn more.

8/14/24

Re:Build Manufacturing has a generational vision to re-energize American manufacturing with high tech design and engineering capabilities across our critical industrial sectors, including aerospace, healthcare, defense, and cleantech. Core to its mission is creating enduring jobs while strengthening vulnerable supply chains. General Catalyst is investing $120MM to help support Re:Build’s vision. Learn more.

8/13/24

Flowserve Corporation, a leading provider of flow control products and services for the global infrastructure markets, has acquired MOGAS Industries, a privately held, Houston-based provider of mission-critical severe service valves and associated aftermarket services for $290 million with a potential $15 million earnout. The Transaction is expected to close in the fourth quarter of 2024. Learn more.

8/13/24

Gauge Capital has partnered with the founder and management team of AGT Robotics to provide growth capital and recapitalize the Company. Founded in 1992 and headquartered in Trois Rivieres, QC, AGT is a leading provider of robotic welding solutions for the structural steel and heavy metal fabrication industry. Learn more.

8/12/24

Benford Capital Partners, a Chicago-based private equity investment firm, and its portfolio company, BSC Industries, LLC , have acquired J.G. Industries, Inc., along with its operating subsidiaries Warren Pike, Cohen Machinery Co., and W.M. Steel Co. Established in 1972 and headquartered in Hopkinton, MA, Warren Pike is a value-added distributor of power transmission, motion control, and fluid power products. Learn more.

8/9/24

Symbotic Inc., a leader in AI-driven robotics for supply chains, has acquired Veo Robotics’ key assets, including the FreeMove® 3D depth-sensing system. By integrating FreeMove into its warehouse automation, Symbotic aims to boost productivity with enhanced human-machine collaboration and greater flexibility. Learn more.

8/7/24

Addtronics, LLC, a consolidator of high-quality, niche automation technology and solution providers innovating for the life sciences and other industries, has acquired Colanar, a leading provider of aseptic fill and finish automation systems for the pharmaceutical industry. Located in Deep River CT, Colanar offers a range of specialty products and solutions, including full lines, benchtop systems, specialty product components, and aftermarket services for the pharmaceutical industry. Learn more.

8/7/24

ATS Corporation, a leading automation solutions provider, has entered into a definitive agreement to acquire all material assets from Heidolph Instruments GmbH & Co. KG and Hans Heidolph GmbH, a leading manufacturer of premium lab equipment for the life sciences and pharmaceutical industries, subject to closing conditions in the agreement. Learn more.

8/6/24

The vacuum specialist Schmalz is expanding its gripper portfolio: As of August 5, the family-owned company from Glatten will acquire the mGrip product family from the US company Soft Robotics, including all finger gripper configurations, patents and the associated know-how. Schmalz is thus expanding its market position in the food product handling sector. Learn more.

8/6/24

Climatec, LLC, a Bosch company, has acquired Engineered Control Solutions (ECS), a top building automation provider with offices in North and South Carolina. Founded in 1999, ECS employs around 100 people and serves customers across the Southeast US and nationally, specializing in efficient control and monitoring of HVAC, lighting, and other technical building equipment in various sectors. Learn more.

8/2/24

TKH Group NV has acquired Liberty Robotics Inc. Liberty Robotics, a state-of-the-art 3D vision guidance systems provider for robotic applications. Liberty Robotics has established itself as a key player in automation for the automotive sector, its systems enabling precise end-of-arm robotic guidance for applications including part handling and the application of coatings and sealers. Learn more.

8/2/24

Industrial Physics, the global packaging and material test and measurement provider, has acquired US-based coating thickness measurement specialist, Sensory Analytics, the suppliers of industry-leading SpecMetrix. The addition of SpecMetrix into Industrial Physics’ expanding family of specialist testing brands further increases the range of quality testing solutions available to end markets across the world. Learn more.

8/1/24

Motion & Control Enterprises has acquired Air Automation Engineering, Inc. Founded in 1978, AAE is a distributor of automation products and automated tooling solutions to end-users and OEMs across the Upper Midwest. The Company also offers a wide range of value-added solutions including robotic, PLC and DC tool programming; calibration; and electric, pneumatic and DC assembly tool repair, and is a factory authorized service center for Epson robots. Learn more.

8/1/24

Sunbelt Solomon Services, a leading provider of customized electrical power solutions and services, has acquired Maxima Power Group. Comprised of Magna IV Engineering Inc., Power Solutions Group LLC. and Industrial Tests Inc., Maxima is a NETA accredited electrical engineering, automation solutions, and technical field services provider. Learn more.

7/30/24

Angeles Equity Partners’ portfolio company, Acieta, has acquired Capital Industries LLC, an Indiana-based robotics manufacturer and integrator. This acquisition is Angeles’ fifth in the robotics sector and enhances Acieta’s capabilities in material handling, assembly systems, and testing and control across various markets, including medical, food and beverage, energy storage, consumer products, and aerospace. Learn more.

7/30/24

L Squared Capital Partners and CogneSense have completed the acquisition of L&J Technologies. L&J is the first acquisition made by CogneSense since its founding by L Squared in late 2023. CogneSense, led by Paul Dhillon, is pursuing a buy and build strategy with a focus on combining longstanding, trusted, and leading environmental sensing, measurement, monitoring, and control businesses with younger companies that add additional technological innovation and capabilities. Learn more.

7/25/24

One Equity Partners, a middle market private equity firm,, has signed a binding agreement to make a majority investment in Comau S.p.A. a global technology company specializing in industrial automation and advanced robotics. The spinoff of Comau is part of the strategic agreement set during the merger between former FCA and Groupe PSA in January 2021 that formed Stellantis N.V. Learn more.

7/24/24

Lucid Bots, a pioneer in robotics, has acquired Avianna, an AI company that enables robots to understand human language and operate autonomously. This strategic partnership marks a major milestone in Lucid Bots’ mission to create intelligent, productive, and responsible robots integrated into daily life. Learn more.

7/23/24

IDEX Corporation has entered into a definitive agreement to acquire Mott Corporation and its subsidiaries for cash consideration of $1 billion (the “transaction”), subject to customary adjustments. Mott is a leader in the design and manufacturing of sintered porous material structures and flow control solutions, with deep applied material science knowledge and process control capabilities. Learn more.

7/23/24

Sojo Industries, a leading mobile automation and robotics manufacturer for food and beverage assembly, today announced that it has partnered with Schreiber Foods, a global food manufacturer with over $7 billion in sales across five continents. Sojo Industries also announced it has raised a Series A round of $10 million with participation from Schreiber Ventures and Tech Council Ventures, an early-stage fund that manages over $175 million. Learn more.

7/23/24

LFM Capital, a private equity firm focused on lower middle market manufacturing and industrial services businesses, stated that portfolio company SureKap LLC has acquired Technical Beverage Services. SureKap provides automated packaging equipment to a variety of industries, including food & beverage, pharmaceuticals, nutraceuticals, and cosmetics. Learn more.

ONLINE extra

Bundy Group is a boutique investment bank that specializes in representing controls and automation, Internet of Things, and cybersecurity companies in business sales, capital raises, and acquisitions. Over the past 33 years, Bundy Group has advised and closed on over 250 transactions, which includes numerous automation-related transactions. You can learn more at www.bundygroup.com or by contacting Clint Bundy.